Navigating the landscape of health insurance in the USA can be complex, especially as costs continue to evolve. In 2025, understanding the factors that influence health insurance pricing is essential for making informed decisions. This guide provides key insights into premium structures, coverage options, and the implications of policy changes, empowering consumers to choose the best plan for their needs.

As we approach 2025, understanding the **cost of health insurance** plans in the USA becomes increasingly vital. The landscape of health insurance is constantly evolving, influenced by factors such as government policies, market trends, and consumer needs. In this article, we will delve into the various components that contribute to the cost of health insurance and how you can make informed decisions when selecting a plan.

Several factors play a significant role in determining the **cost of health insurance** in the United States. Here are some of the most critical elements to consider:

1. Age: Age is one of the most significant factors affecting health insurance premiums. Generally, older individuals tend to pay higher premiums due to increased health risks. Insurers often use age bands to determine rates, meaning that as you age, your healthcare costs are likely to increase.

2. Location: The cost of health insurance varies widely across different states and regions. Urban areas typically have higher premiums than rural locations. This disparity is due to the concentration of healthcare providers, local regulations, and the overall cost of living.

3. Coverage Level: The type of coverage you choose has a direct impact on your premiums. Plans with higher coverage levels, such as those with lower deductibles and copays, tend to be more expensive. Conversely, high-deductible plans usually have lower premiums but require you to pay more out-of-pocket before coverage kicks in.

4. Lifestyle Choices: Factors such as smoking, obesity, and overall health can influence your health insurance costs. Insurers often assess your health status when determining your premiums, so maintaining a healthy lifestyle can lead to lower costs.

Understanding the different types of health insurance plans is crucial for making an informed decision. Here are some common types of plans available in the USA:

1. Health Maintenance Organization (HMO): HMO plans typically offer lower premiums but require you to choose a primary care physician (PCP) and get referrals for specialists. They are a cost-effective option for those who prefer a coordinated approach to healthcare.

2. Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers and do not require referrals for specialists. However, they usually come with higher premiums. PPOs are ideal for individuals who want a wider range of choices.

3. Exclusive Provider Organization (EPO): EPO plans combine elements of HMO and PPO plans. They offer lower premiums but require you to use a network of providers. Unlike HMOs, EPOs do not require referrals for specialists.

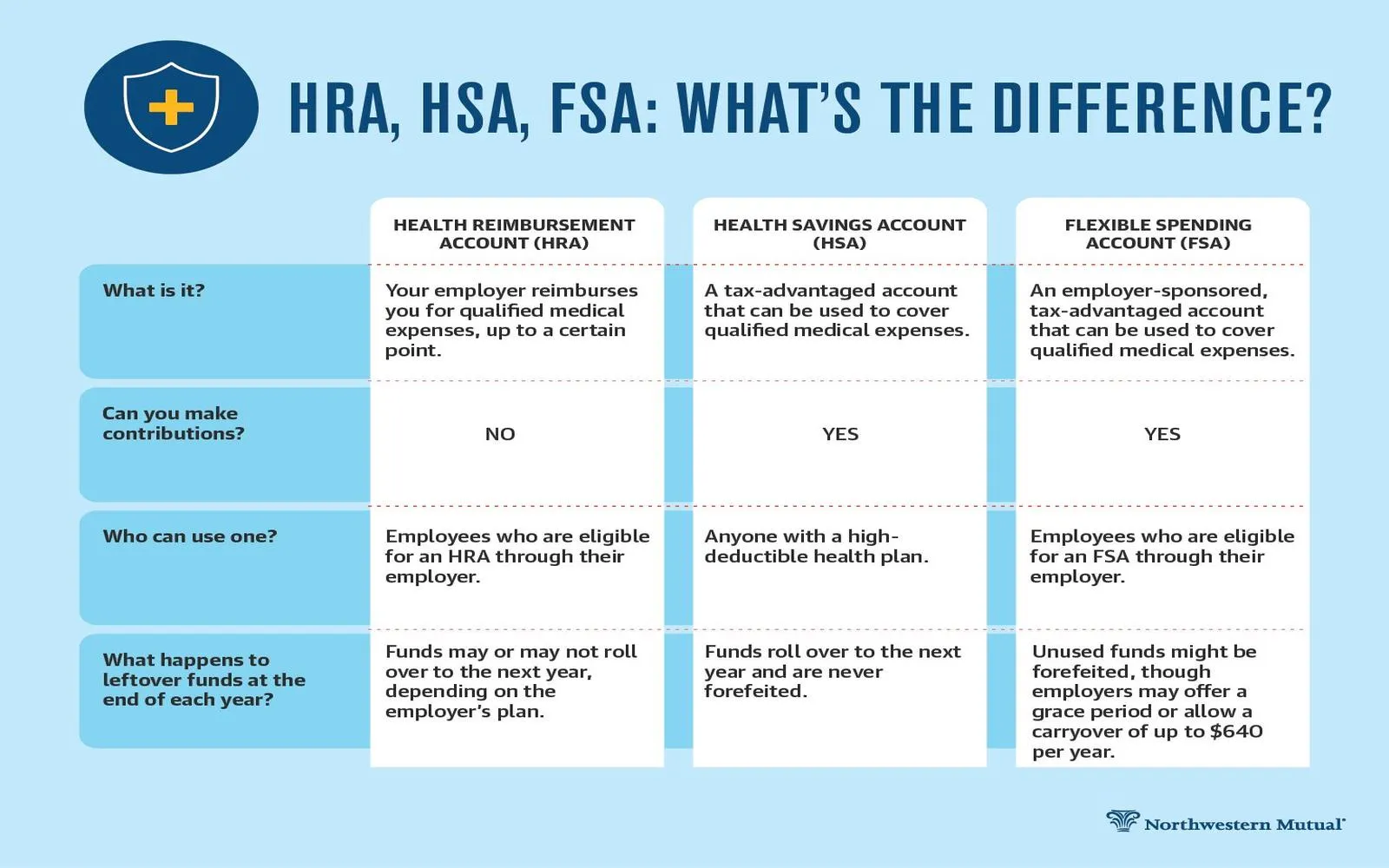

4. High-Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles. They are often paired with Health Savings Accounts (HSAs), allowing you to save on taxes for qualified medical expenses. These plans are suitable for those who are generally healthy and want to save on monthly costs.

The Affordable Care Act (ACA) has significantly influenced the **cost of health insurance** in the USA. It introduced various regulations aimed at making health insurance more accessible and affordable. Some key provisions include:

1. Guaranteed Issue: Insurers cannot deny coverage based on pre-existing conditions, which has helped reduce costs for those with chronic illnesses.

2. Premium Subsidies: The ACA provides subsidies for low- and middle-income individuals, making health insurance more affordable. These subsidies vary based on household income and family size.

3. Essential Health Benefits: The ACA mandates that all health insurance plans cover ten essential health benefits, ensuring that consumers have access to a comprehensive range of services.

While it's challenging to predict the exact costs of health insurance for 2025, several trends can provide insight. According to recent studies, the average annual premium for employer-sponsored health insurance is expected to rise. Factors contributing to this increase include:

- Rising healthcare costs due to advancements in medical technology and pharmaceuticals.

- An aging population requiring more healthcare services.

- Increased demand for mental health and preventive services.

While these factors may lead to higher premiums, the introduction of new health insurance models and services may help offset some of these costs in the coming years.

To navigate the **cost of health insurance** effectively, it’s essential to evaluate your healthcare needs and financial situation. Here are some tips to consider:

1. Assess Your Health Needs: Consider your current health status, any chronic conditions, and anticipated medical needs in the coming year.

2. Compare Plans: Use online tools and resources to compare different health insurance plans, focusing on premiums, deductibles, and out-of-pocket costs.

3. Seek Professional Advice: Consult with a licensed insurance agent or financial advisor who can provide personalized guidance based on your situation.

By understanding the **cost of health insurance** and the factors influencing it, you can make informed choices that align with your healthcare needs and financial goals as we move into 2025.

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

Top Trends in Health Insurance Plans in the USA 2025: Innovations and Changes Ahead

How to Choose the Right Health Insurance Plan in the USA 2025: Tips for Consumers

The Impact of Legislation on Health Insurance Plans in the USA 2025: What to Expect

Health Insurance Plans for Families in the USA 2025: Finding the Best Options for Your Needs

Best Health Insurance Plans in the USA (2025)

Top Dental Insurance Plans in the USA for 2025: What You Need to Know

Affordable Life Insurance Plans: What You Need to Know in 2025