As the landscape of health insurance in the USA evolves, upcoming legislation in 2025 promises to reshape coverage options, costs, and accessibility. This analysis explores the anticipated effects of new laws on health insurance plans, examining potential changes in consumer protections, premium rates, and the overall quality of care, offering insights into what individuals and families can expect in the near future.

The landscape of health insurance in the United States is continually evolving, influenced by various factors such as economic conditions, public demand, and, crucially, legislation. As we approach 2025, significant **legislative changes** are anticipated, which will have profound effects on **health insurance plans** across the country. Understanding these changes is essential for consumers, providers, and policymakers alike, as they prepare for a new era in American healthcare.

As of 2023, the U.S. health insurance market is characterized by a mix of private and public insurance plans. The Affordable Care Act (ACA), enacted in 2010, has been a pivotal piece of legislation that expanded coverage and improved consumer protections. However, despite these advancements, many Americans still face challenges in accessing affordable healthcare. Rising costs and fluctuating premiums have led to increased scrutiny of health insurance policies and the need for reform.

Several key legislative trends are expected to shape **health insurance plans** as we approach 2025:

Based on current legislative trends, several changes in **health insurance plans** can be expected by 2025:

In addition to legislative changes, technology will play a crucial role in shaping **health insurance plans** in 2025. The integration of advanced data analytics and artificial intelligence can lead to more personalized health insurance options and improved patient outcomes. Insurers are likely to leverage technology to better understand consumer needs and tailor their offerings accordingly.

The following chart outlines anticipated changes in health insurance plans as influenced by upcoming legislation:

| Change | Impact | Expected Timeline |

|---|---|---|

| Medicaid Expansion | Increased coverage for low-income individuals | By 2025 |

| Drug Pricing Reforms | Lower out-of-pocket costs for prescriptions | By 2025 |

| Increased Subsidies | More affordable marketplace plans | By 2025 |

| Telehealth Mandates | Wider access to healthcare services | By 2025 |

| Enhanced Consumer Protections | Reduced financial burden from unexpected bills | By 2025 |

As we look forward to the changes expected in 2025, it is essential for consumers to stay informed and proactive. Here are a few steps individuals can take:

The impact of legislation on **health insurance plans** in the USA by 2025 is poised to be significant. With a focus on expanding access, reducing costs, and enhancing consumer protections, the future of health insurance may become more favorable for many Americans. Staying informed and adapting to these changes will be crucial for consumers navigating the evolving healthcare landscape.

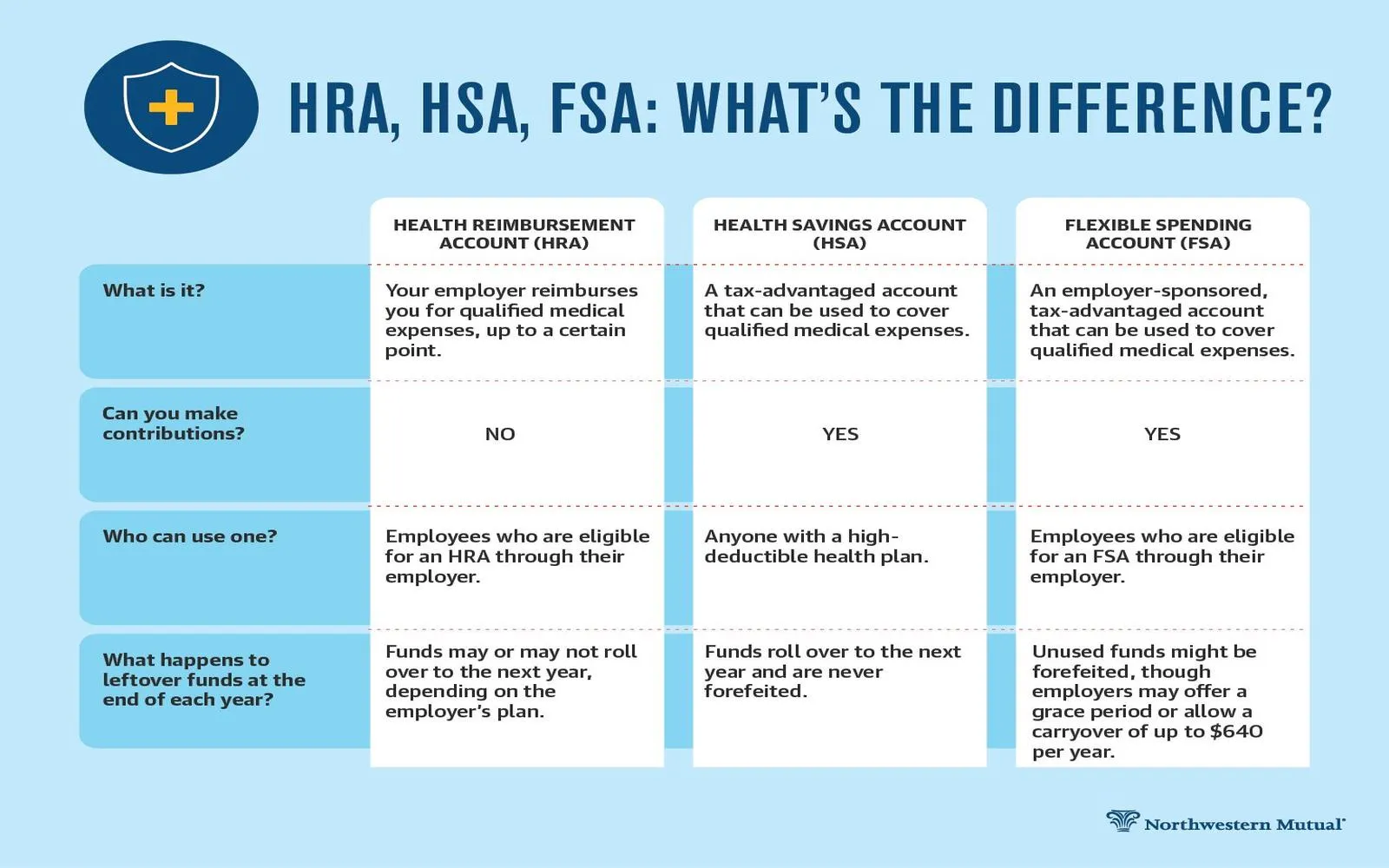

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

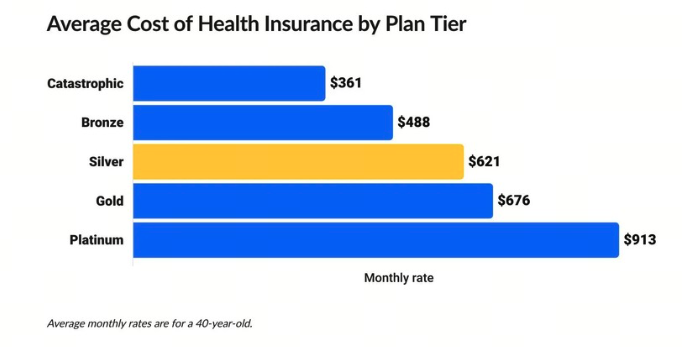

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Top Trends in Health Insurance Plans in the USA 2025: Innovations and Changes Ahead

How to Choose the Right Health Insurance Plan in the USA 2025: Tips for Consumers

Health Insurance Plans for Families in the USA 2025: Finding the Best Options for Your Needs

Best Health Insurance Plans in the USA (2025)

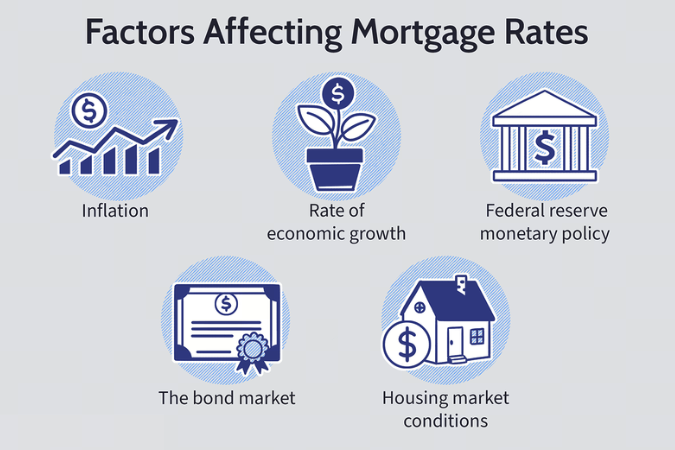

Impact of Economic Changes on Mortgage Loans in the USA: What to Expect in 2025

The Impact of 5G on Business Internet Providers in the USA: What to Expect in 2025