Explore the evolving landscape of health insurance plans in the USA for 2025 with this comprehensive guide. Discover a variety of coverage options tailored to meet diverse needs, including individual, family, and employer-sponsored plans. Gain insights into benefits, costs, and regulatory changes, empowering you to make informed decisions for your health and financial well-being.

As we look ahead to 2025, the landscape of health insurance plans in the USA is evolving rapidly. With new regulations, emerging technologies, and changing consumer needs, it’s crucial to stay informed about the various coverage options available. This comprehensive guide will help you navigate through the complexities of health insurance in the United States.

There are several types of health insurance plans available in the USA. Each offers different levels of coverage, costs, and flexibility. Understanding these types can help you make informed decisions. Here are the most common types:

In 2025, health insurance plans are expected to continue evolving, with a broader range of coverage options available. Here’s a look at some key areas that will shape health insurance:

Preventive care services, such as vaccinations, screenings, and annual check-ups, will remain a crucial part of health insurance plans. Most plans are expected to cover these services at no cost to members, encouraging individuals to prioritize their health and well-being.

The importance of mental health has gained significant recognition in recent years. In 2025, more health insurance plans are likely to include comprehensive mental health coverage, ensuring that individuals have access to essential services such as therapy, counseling, and medication management.

With the rise of digital healthcare, telehealth services will continue to expand. In 2025, many health insurance plans will likely offer virtual consultations as a standard feature, making healthcare more accessible and convenient for patients.

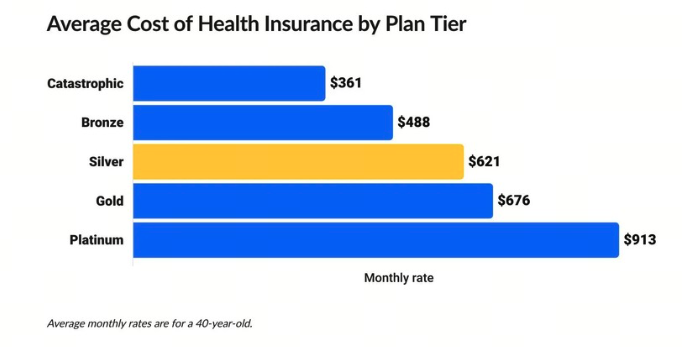

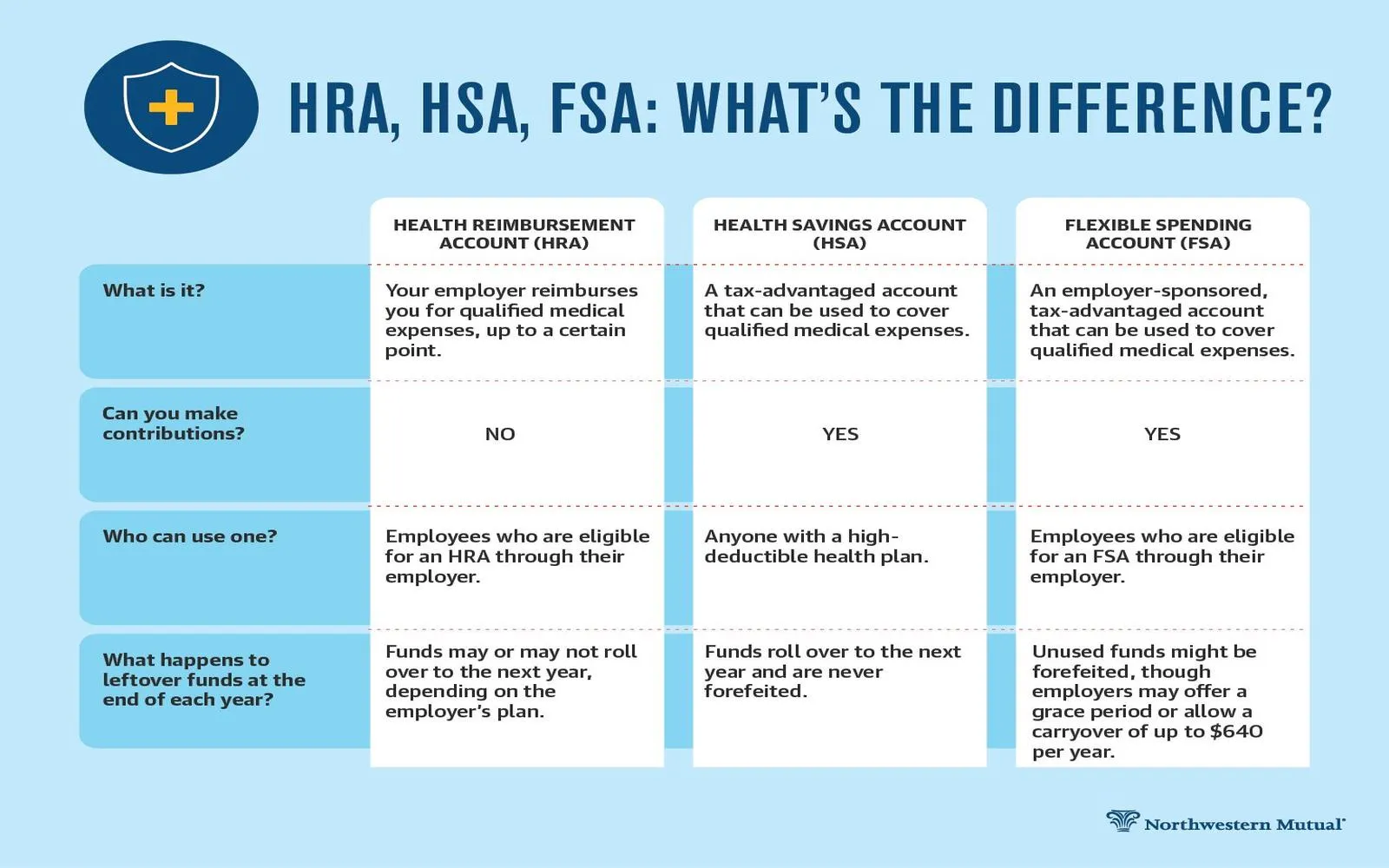

Understanding the costs associated with health insurance plans is key to making the right choice. Here are some important financial factors to consider:

When selecting a health insurance plan in 2025, consider the following steps:

The health insurance landscape in the USA is set to change significantly by 2025. By understanding the various types of health insurance plans, coverage options, and cost considerations, you can make informed choices that best suit your healthcare needs. Stay proactive, stay informed, and take control of your health insurance journey for a healthier future.

| Plan Type | Premiums | Flexibility | Required Referrals |

|---|---|---|---|

| HMO | Low | Low | Yes |

| PPO | High | High | No |

| EPO | Medium | Medium | No |

| POS | Medium | Medium | Yes |

| HDHP | Low | Medium | No |

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Top Trends in Health Insurance Plans in the USA 2025: Innovations and Changes Ahead

How to Choose the Right Health Insurance Plan in the USA 2025: Tips for Consumers

The Impact of Legislation on Health Insurance Plans in the USA 2025: What to Expect

Health Insurance Plans for Families in the USA 2025: Finding the Best Options for Your Needs

Best Health Insurance Plans in the USA (2025)

Top Life Insurance Plans in the USA for 2025: A Comprehensive Guide

The Cost of Dental Care vs. Insurance Coverage: A 2025 Perspective in the USA