The landscape of dental care in the USA is evolving rapidly, particularly as we approach 2025. Understanding the **cost of dental care** versus available **insurance coverage** is crucial for individuals and families navigating their oral health needs. This article aims to shed light on the financial implications of dental care and how insurance can alleviate some of these costs.

As we look ahead to 2025, the **cost of dental care** continues to rise, driven by various factors such as inflation, advancements in dental technology, and an aging population. According to the American Dental Association, the average cost of routine dental services has increased by approximately 3-5% annually over the past decade. For example, a standard cleaning, which may have cost around $100 in 2020, is projected to exceed $130 by 2025.

Moreover, specialized treatments such as crowns, root canals, and orthodontics can be significantly more expensive. A crown that previously cost $1,200 might rise to $1,500 or more in the next few years. These rising costs put a strain on individuals, especially those without adequate **dental insurance coverage**.

Dental insurance plays a pivotal role in mitigating the high costs associated with dental care. Most dental insurance plans cover preventive services, such as routine check-ups and cleanings, at little to no out-of-pocket expense. However, when it comes to more complex procedures, the coverage can vary significantly.

Typically, dental insurance plans operate on a tiered structure, where preventive services are fully covered, basic services (like fillings and extractions) are covered at around 80%, and major services (such as crowns and bridges) are usually covered at about 50%. As we move towards 2025, understanding these coverage percentages is crucial for budgeting dental expenses.

Even with insurance, many individuals face out-of-pocket costs, which can be substantial. For instance, if you require a root canal and your insurance covers 80% of the procedure costing $1,500, you would still be responsible for $300. This amount can be a hefty burden, especially for families with multiple dental needs.

As more people seek dental care, the demand for services is expected to grow, potentially leading to even higher costs. Therefore, individuals should carefully evaluate their **dental insurance plans** to ensure they align with their anticipated needs. It is also advisable to explore flexible spending accounts (FSAs) or health savings accounts (HSAs) to help offset some of these out-of-pocket costs.

As we approach 2025, several trends are emerging in the world of **dental insurance**. One noticeable trend is the shift towards more comprehensive plans that offer broader coverage options. Many insurers are starting to recognize the importance of preventive care and are incentivizing regular check-ups and cleanings.

Additionally, tele-dentistry is gaining traction, providing patients with virtual consultations and follow-ups. This innovation can lead to reduced costs overall, as it eliminates the need for in-person visits for routine questions or follow-ups.

Furthermore, there is a growing emphasis on wellness and holistic approaches to dental care. Some insurance plans are beginning to cover alternative therapies, such as acupuncture or nutritional counseling, which can indirectly improve oral health.

Preventive care is the cornerstone of any successful dental health strategy. Regular check-ups and cleanings not only help maintain oral health but can also identify potential issues before they escalate into more costly procedures. The American Dental Association recommends visiting the dentist at least twice a year for routine cleanings and exams.

Investing in preventive care can save individuals a considerable amount of money in the long run. For example, treating a small cavity early on may only cost $150, whereas waiting until it becomes a more serious issue could result in a root canal costing upwards of $1,500. Thus, having a solid preventive care plan can significantly reduce overall dental expenses.

As we look towards 2025, understanding the **cost of dental care** in relation to **insurance coverage** is essential for effective financial planning. The rising costs of dental services necessitate a proactive approach to both preventive care and insurance selection. By staying informed and making strategic decisions, individuals can navigate the complexities of dental care costs and insurance coverage, ultimately leading to better oral health and financial well-being.

In conclusion, taking the time to explore various insurance options, understanding out-of-pocket expenses, and prioritizing preventive care can empower individuals to manage their dental health effectively and affordably in the coming years.

The Impact of Telehealth on Rehab Centers in the USA: A 2025 Perspective.

The Impact of Tax Deductions on Donation Trends in the USA: A 2025 Perspective

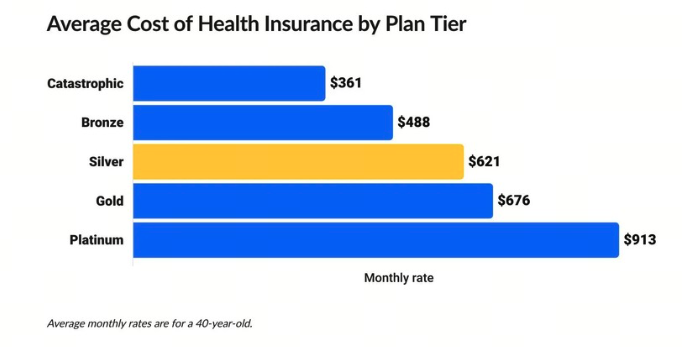

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

Understanding the Cost of Hiring an Accident Attorney in the USA: What to Expect in 2025.

Cost vs. Value: Analyzing the ROI of Online Master’s Degree Programs in the USA for 2025

Cost-Effective Business Internet Solutions: Providers to Watch in the USA 2025

Cost-Effective VoIP Options for Small Businesses in the USA: A 2025 Guide