In 2025, the landscape of charitable giving in the USA is significantly influenced by tax deductions. These incentives encourage individuals and corporations to increase their donations, enhancing support for nonprofits. As tax policies evolve, understanding the relationship between deductions and donation trends becomes crucial for organizations aiming to maximize funding and sustain their missions in a competitive philanthropic environment.

As we look ahead to 2025, understanding the relationship between **tax deductions** and **donation trends** in the USA is crucial for both charitable organizations and potential donors. The influence of tax policies on charitable giving has been well-documented, and as tax laws evolve, so too do the patterns of philanthropy across the nation. In this article, we will explore how the anticipated changes in tax deductions may shape the landscape of donations in the coming years.

In the USA, individuals can deduct charitable contributions from their taxable income, which has historically encouraged generous giving. According to the IRS, taxpayers can deduct donations made to qualifying charitable organizations, which include nonprofits, religious institutions, and educational entities. The **standard deduction** and **itemized deductions** play a significant role in how much individuals are willing to donate, affecting overall donation trends.

As of 2023, the Tax Cuts and Jobs Act (TCJA) has significantly influenced donation behaviors. By nearly doubling the standard deduction, fewer taxpayers find it beneficial to itemize their deductions. This change has led to a decline in the number of itemizers, which in turn has affected charitable contributions. With the standard deduction currently at $12,950 for individuals and $25,900 for married couples, many potential donors have seen less incentive to contribute, impacting overall donation levels.

Looking toward 2025, there are discussions around potential changes to tax policy that could further influence donation trends. One proposal includes reinstating or expanding tax incentives for charitable giving to encourage higher philanthropic participation. If implemented, these changes could lead to a more favorable environment for donors, particularly for those who earn above the standard deduction threshold.

Another consideration is the potential introduction of **universal charitable deductions**, which would allow all taxpayers, regardless of whether they itemize, to deduct charitable contributions. This could significantly boost donations, especially among lower- and middle-income earners who may feel less incentivized to give under the current system.

Beyond the financial implications, the psychological impact of tax deductions on potential donors cannot be overlooked. Tax incentives can create a sense of urgency and motivation to give. When taxpayers know that their contributions will reduce their tax liabilities, they may be more likely to donate larger sums or contribute more frequently.

In addition, the **social influence** of tax deductions plays a critical role in shaping donation behaviors. When individuals see their peers donating and benefiting from tax deductions, they may feel compelled to participate in charitable giving. This communal aspect of philanthropy is essential for sustaining and increasing donation levels across the country.

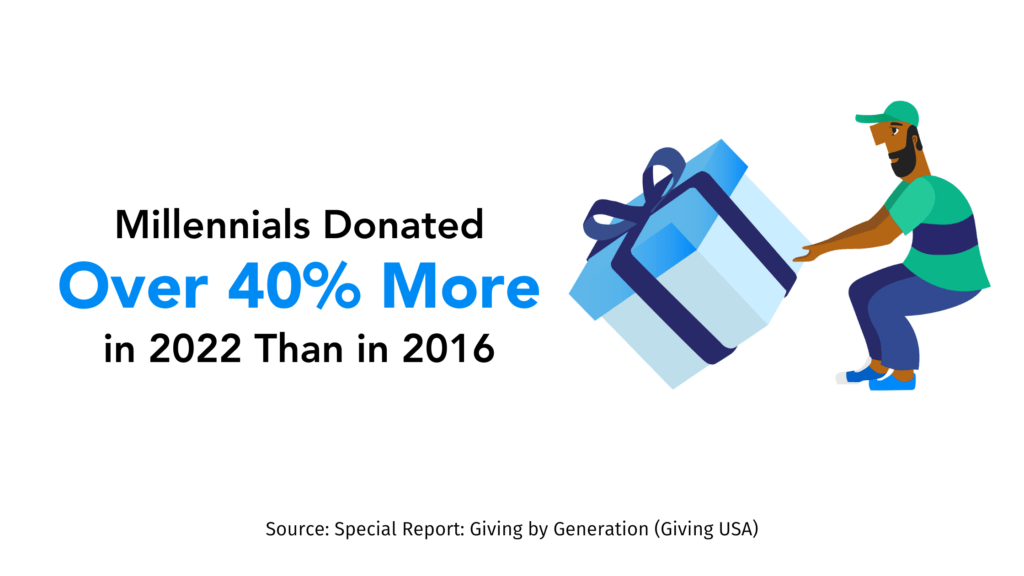

With the rise of technology and digital platforms, the way people donate has transformed. Online giving has become increasingly popular, especially among younger generations who prefer the convenience of digital transactions. Tax deductions play a crucial role in this sector, as many online platforms emphasize the tax benefits of donating. By highlighting the potential deductions, these platforms can encourage more donations and foster a culture of giving.

In 2025, we can expect to see even more advancements in online giving technology, including streamlined processes for claiming tax deductions. This may lead to a further increase in donations, as ease of access and understanding of tax benefits will encourage more individuals to contribute to charitable organizations.

As we approach 2025, it is essential for both donors and charitable organizations to stay informed about the potential changes in tax laws and their implications for philanthropic giving. Understanding how **tax deductions** impact **donation trends** will be vital for maximizing contributions and ensuring that nonprofits can continue their valuable work in communities across the USA.

Organizations must also adapt their fundraising strategies to align with evolving tax policies, utilizing technology to promote the benefits of giving. By fostering a culture of understanding around tax deductions, nonprofits can encourage more individuals to participate in charitable giving, ultimately leading to a stronger philanthropic landscape.

In summary, as we look to the future, the interplay between tax deductions and donation trends will shape the philanthropic landscape in the USA. Embracing these changes and understanding their implications will be essential for all stakeholders involved in charitable giving.

Best Charities to Donate to in the USA (2025 Guide)

The Future of Charitable Giving: Trends in Donation in the USA for 2025

How Technology is Transforming Donation Practices in the USA by 2025

Donating Pays Off: Top Tax Advantages You Can Claim in 2025

Millennials and Donation in the USA: Shaping Philanthropy in 2025

Corporate Social Responsibility: The Role of Businesses in Donation Trends in the USA by 2025

Top-Rated Donation Websites: The Best Places to Give in 2025

The Impact of Telehealth on Rehab Centers in the USA: A 2025 Perspective.