Donating to charitable organizations not only supports important causes but also offers significant tax advantages. In 2025, you can claim deductions for cash and non-cash contributions, maximizing your tax savings. Be sure to keep accurate records and understand the limits on deductions. Additionally, consider donating appreciated assets to avoid capital gains taxes, further enhancing your financial benefits.

As we approach the tax year of 2025, many individuals are looking for ways to optimize their tax returns. One effective strategy that often gets overlooked is the act of donating to charitable organizations. Not only does donating help those in need, but it also comes with several **tax advantages** that can significantly impact your financial situation. Here, we will explore the top **tax benefits** associated with charitable donations and how you can maximize these advantages in 2025.

When you donate to a qualified charitable organization, you may be eligible to claim a **tax deduction** on your federal income tax return. This deduction can help lower your taxable income, thus reducing the amount of tax you owe. Here are some key points to consider:

Donations can come in various forms, including cash, property, and even stocks. Each type of donation may offer different **tax benefits**:

As tax laws evolve, new incentives for charitable giving may arise. In 2025, there are a few notable provisions that may enhance the **tax advantages** of donating:

To make the most of your charitable donations and ensure you can claim all eligible **tax benefits**, follow these best practices:

Donating to charity not only contributes to the well-being of others but also serves as a smart financial strategy. By understanding the **tax advantages** available in 2025 and following best practices for claiming your deductions, you can maximize your financial benefits while making a positive impact in your community. Remember, every donation counts—both for your tax return and for those you help.

In summary, whether you are giving cash, property, or stocks, there are numerous ways to take advantage of the tax benefits associated with charitable contributions. Stay informed about any changes to tax laws and keep your records organized to ensure you can fully benefit from the generosity you extend to those in need.

Eco-Friendly Cruise Deals in the USA 2025: Sustainable Travel Options You Can't Miss

The Impact of Tax Deductions on Donation Trends in the USA: A 2025 Perspective

How Solar Roof Tiles Can Increase Your Home's Value in 2025

The Environmental Impact of Solar Roof Tiles: What We Can Expect in 2025

Customer Experience in Online Banking: What Users Can Expect in the USA 2025.

How VoIP Can Transform Communication for Small Businesses in the USA by 2025

Affordable Life Insurance Plans: What You Need to Know in 2025

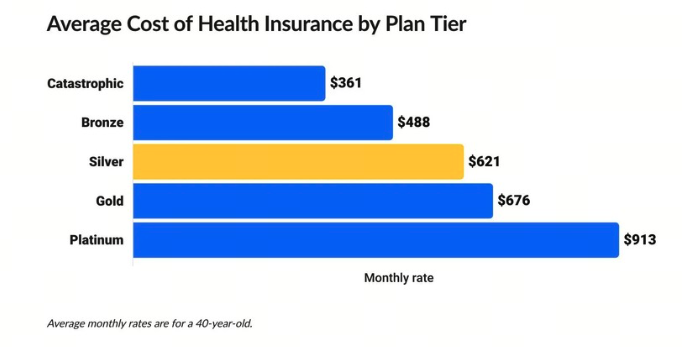

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know