Navigating the world of life insurance can be overwhelming, especially with the myriad of options available in 2025. This guide explores affordable life insurance plans, highlighting key features, benefits, and essential tips to help you make informed decisions. Discover how to secure your family’s financial future without breaking the bank, ensuring peace of mind for years to come.

As we move into 2025, the landscape of life insurance continues to evolve, making it crucial for individuals to be informed about their options. Affordable life insurance plans are designed to provide essential coverage without breaking the bank. However, understanding the various types of policies and their features can help you make an informed decision.

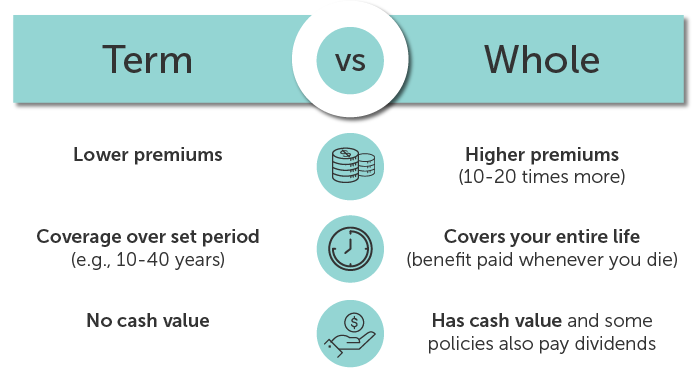

There are primarily two types of life insurance: term life and whole life. Each type has its benefits and drawbacks, and understanding them can help you choose a plan that fits your needs.

Term Life Insurance is generally more affordable than whole life insurance. This type of policy covers you for a specified period, typically ranging from 10 to 30 years. If you pass away during this term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires, and you do not receive any payout. This policy is ideal for individuals seeking affordable premiums and temporary coverage, especially for those with specific financial obligations, such as a mortgage or children's education.

Whole Life Insurance, on the other hand, provides lifelong coverage and includes a savings component known as cash value. While the premiums are higher compared to term life, the policy accumulates cash value over time, which you can borrow against or withdraw if needed. Whole life insurance is suitable for those looking for long-term financial security and a savings element.

Several factors influence the premiums of affordable life insurance plans, including:

Understanding these factors can help you assess your risk profile and choose the most suitable plan for your financial situation.

When searching for affordable life insurance plans, consider the following steps to ensure you find the best policy for your needs:

To give you a clearer picture of what to expect in terms of costs, we have compiled a chart that outlines average premiums for different types of life insurance policies based on age and coverage amount:

| Age | Term Life (20-Year Policy, $500,000 Coverage) | Whole Life (Age 30, $500,000 Coverage) |

|---|---|---|

| 25 | $20/month | $350/month |

| 35 | $25/month | $400/month |

| 45 | $40/month | $500/month |

| 55 | $70/month | $800/month |

As illustrated in the chart, premiums increase with age, making it advantageous to secure an affordable plan earlier in life. The difference in costs between term and whole life is also significant, emphasizing the importance of determining your specific needs and financial goals.

There are several misconceptions that can deter individuals from purchasing life insurance. Here are a few:

Understanding affordable life insurance plans in 2025 is essential for securing your financial future and protecting your loved ones. By assessing your needs, shopping around for quotes, and debunking common misconceptions, you can find a policy that fits your budget and provides the necessary coverage. Remember, the earlier you secure your life insurance, the more affordable it is likely to be. Take the time to explore your options and make an informed decision that aligns with your financial goals.

How to Choose the Best Life Insurance Plan in the USA: 2025 Insights

The Impact of COVID-19 on Life Insurance Trends in the USA for 2025

Navigating Life Insurance for Seniors: Best Plans in the USA for 2025"

Best Life Insurance Plans in the USA in 2025

Top Life Insurance Plans in the USA for 2025: A Comprehensive Guide

Understanding the Benefits of Term vs. Whole Life Insurance in 2025

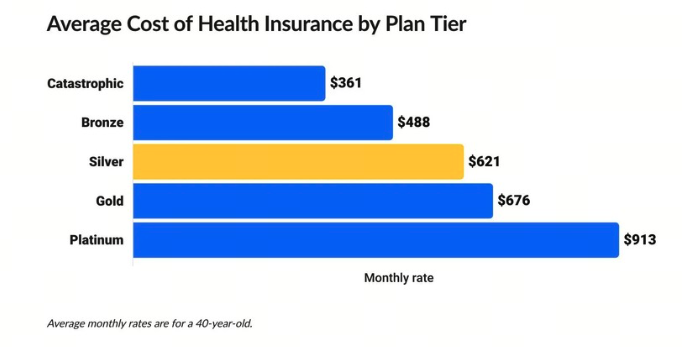

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Top Dental Insurance Plans in the USA for 2025: What You Need to Know