Navigating the world of life insurance can be daunting, especially with the multitude of options available in the USA. In this guide, we provide essential insights for 2025 to help you identify the best life insurance plan for your unique needs. From understanding policy types to evaluating coverage amounts, we equip you with the knowledge to make informed decisions.

Choosing the best life insurance plan in the USA can be a daunting task, especially with the multitude of options available today. As we look towards 2025, understanding the nuances of different policies, coverage options, and market trends is essential for making informed decisions. Here’s a comprehensive guide to help you navigate the process of selecting the ideal life insurance policy that fits your needs.

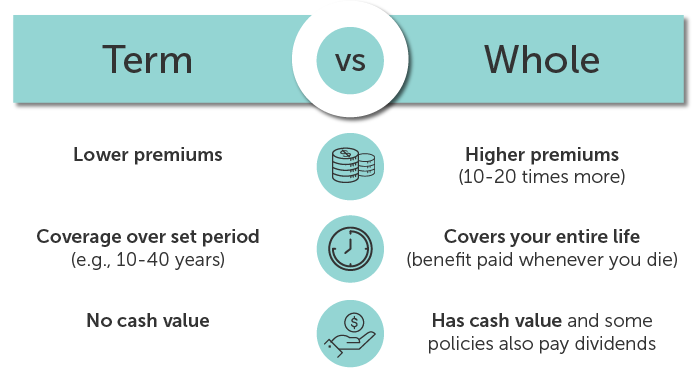

Before diving into the specifics of choosing a plan, it's crucial to understand the main types of life insurance available:

Determining how much life insurance you need is a critical step in selecting a plan. Consider the following factors:

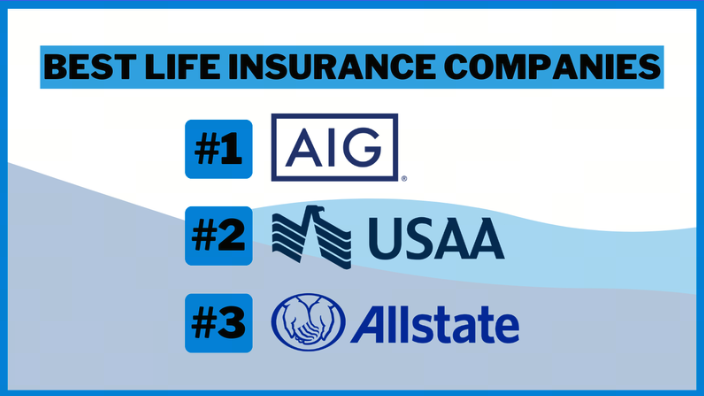

Once you've assessed your needs, the next step is to compare different life insurance providers. Here are some tips to help you in your comparison:

Every life insurance policy has exclusions—situations in which the insurer will not pay out a claim. Common exclusions include:

Always read the policy documents carefully to understand what is and isn't covered.

As we approach 2025, technology is revolutionizing the life insurance industry. Here are some trends to consider:

Choosing the best life insurance plan in the USA requires careful consideration of your personal needs, financial situation, and the options available in the market. By understanding the different types of life insurance, assessing your needs, comparing providers, and staying informed about emerging trends, you can make a well-informed decision that provides peace of mind for you and your loved ones. As you look towards 2025, remember that the right life insurance policy is one that aligns with your financial goals and protects your family’s future.

Top Life Insurance Plans in the USA for 2025: A Comprehensive Guide

Understanding the Benefits of Term vs. Whole Life Insurance in 2025

The Impact of COVID-19 on Life Insurance Trends in the USA for 2025

Affordable Life Insurance Plans: What You Need to Know in 2025

Navigating Life Insurance for Seniors: Best Plans in the USA for 2025"

Best Life Insurance Plans in the USA in 2025

How to Choose the Right Health Insurance Plan in the USA 2025: Tips for Consumers

How to Choose the Best Dental Insurance in the USA for 2025