Navigating the world of life insurance can be challenging, especially when deciding between term and whole life policies. In 2025, understanding the unique benefits of each option is crucial for making informed financial decisions. This guide explores the key features, costs, and long-term advantages of term versus whole life insurance, empowering you to choose the best protection for your needs.

Term life insurance is a type of life insurance policy that provides coverage for a specific period, typically ranging from 10 to 30 years. During this term, if the insured individual passes away, the beneficiaries receive a death benefit. If the policyholder outlives the term, the coverage ends, and there is no payout. This type of insurance is often more affordable than whole life insurance, making it an attractive option for many people.

One of the primary benefits of term life insurance is its cost-effectiveness. Since it provides coverage for a limited time and does not accumulate cash value, premiums tend to be significantly lower compared to whole life policies. This affordability allows individuals to obtain higher coverage amounts without straining their budgets. Additionally, term life insurance is straightforward and easy to understand, making it an appealing choice for those new to life insurance.

Another advantage is flexibility. Policyholders can choose the term length that best suits their needs, whether it’s to cover a mortgage, raise children, or meet other financial obligations. Many term policies also come with the option to convert to a whole life policy later, providing a pathway for long-term coverage if circumstances change.

Whole life insurance is a type of permanent life insurance that offers coverage for the policyholder's entire lifetime, provided premiums are paid. This policy not only provides a death benefit but also accumulates cash value over time, which can be borrowed against or withdrawn, adding another layer of financial security.

One of the significant benefits of whole life insurance is its lifelong coverage. Unlike term insurance, whole life policies do not expire, ensuring that beneficiaries will receive a payout upon the death of the insured, regardless of when it occurs. This can provide peace of mind for policyholders and their families.

Additionally, the cash value component of whole life insurance can serve as a financial asset. As the cash value grows, it can be borrowed against for various needs, such as education expenses or emergencies. This feature can make whole life insurance an attractive option for those looking to combine life insurance with savings or investment potential.

When deciding between term and whole life insurance, it’s essential to consider individual financial needs and goals. Here’s a comparison chart to help clarify the differences:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10-30 years) | Lifetime |

| Premiums | Generally lower | Generally higher |

| Cash Value | No cash value | Accumulates cash value |

| Flexibility | Can convert to whole life | Fixed policy features |

| Best For | Temporary needs (e.g., mortgage, dependents) | Long-term financial planning and legacy |

Choosing between term and whole life insurance in 2025 depends largely on your financial situation, future goals, and personal preferences. If you’re looking for affordable coverage that provides a safety net during critical years, term life might be the right choice. It allows you to secure a higher death benefit at a lower cost, ideal for covering debts, children's education, or income replacement.

On the other hand, if you want lifelong coverage and the potential for cash value growth, whole life insurance may be more suitable. It’s particularly beneficial for individuals interested in estate planning or those wanting to leave a legacy for their loved ones.

Understanding the benefits of term vs. whole life insurance in 2025 is crucial for making an informed decision that aligns with your financial goals. Evaluate your current situation, consider your future needs, and consult with a financial advisor to determine which type of policy best fits your lifestyle. Whether you choose term or whole life insurance, both can provide essential protection for you and your loved ones.

Top Life Insurance Plans in the USA for 2025: A Comprehensive Guide

Best Life Insurance Plans in the USA in 2025

How to Choose the Best Life Insurance Plan in the USA: 2025 Insights

The Impact of COVID-19 on Life Insurance Trends in the USA for 2025

Affordable Life Insurance Plans: What You Need to Know in 2025

Navigating Life Insurance for Seniors: Best Plans in the USA for 2025"

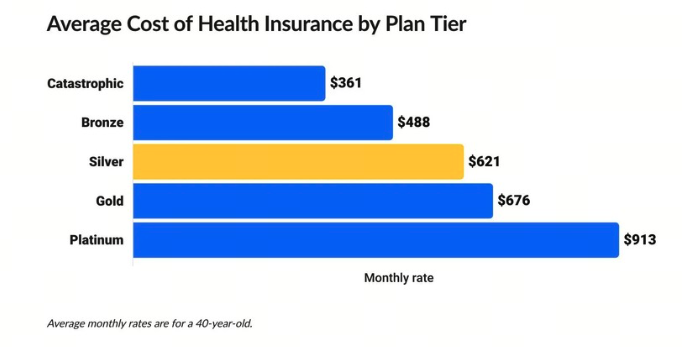

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Understanding Dental Insurance in the USA: Trends and Changes for 2025