As we approach 2025, understanding the landscape of **dental insurance in the USA** becomes increasingly important for individuals and families seeking to manage their oral health care costs. With the rise of new trends and changes in policy, it’s essential to stay informed about how these developments can impact your dental coverage options.

The dental insurance industry is experiencing several significant trends that are shaping the way consumers engage with their dental care. One of the most notable trends is the **increased adoption of tele-dentistry**. As technology continues to advance, patients are finding it easier to consult with dental professionals remotely. This trend not only offers convenience but also helps to reduce costs associated with in-person visits.

Another trend is the growing emphasis on preventive care. Many dental insurance plans are now prioritizing coverage for preventive services, such as routine check-ups and cleanings. This shift aims to encourage patients to seek care before issues escalate, ultimately reducing overall dental expenses. As a result, more plans are offering 100% coverage for preventive services, making them highly accessible.

Furthermore, the rise of **value-based care** is transforming how dental services are delivered and reimbursed. Instead of focusing solely on the quantity of services rendered, insurers are now looking at patient outcomes and satisfaction. This approach incentivizes dental care providers to deliver high-quality care, benefiting both patients and insurers in the long run.

As we look ahead to 2025, it’s essential to recognize the changes in dental insurance policies that may affect coverage options. One significant change is the potential for **increased regulation** of dental insurance providers. Policymakers are becoming more aware of the disparities in access to dental care and are pushing for reforms that could mandate more comprehensive coverage.

Additionally, the expansion of **Medicaid dental coverage** is a critical development to watch. Many states are working to improve dental benefits for Medicaid recipients, which could lead to increased access to dental care for low-income individuals and families. This expansion is vital for addressing oral health disparities and ensuring that everyone can receive the care they need.

Employer-sponsored dental insurance remains a primary source of coverage for many Americans. As companies continue to adapt to changing workforce needs, we may see an increase in the flexibility of dental insurance options offered to employees. This flexibility could include tiered plans that allow employees to choose the level of coverage that best fits their needs and budgets.

Moreover, employers are increasingly recognizing the importance of **employee wellness programs**, which often include dental health education and preventive care initiatives. These programs not only help improve the overall health of employees but can also reduce long-term healthcare costs for employers.

Looking towards 2025, several future trends in dental insurance coverage are emerging. One key trend is the rise of **customized dental plans**. Insurers are beginning to offer more personalized plans that allow individuals to select specific services they want to be covered. This customization can lead to more cost-effective solutions tailored to individual health needs.

Another anticipated trend is the integration of **dental insurance with health insurance**. As healthcare continues to evolve, there is a growing recognition of the connection between oral health and overall health. This integration could lead to more comprehensive plans that address both dental and medical needs, ultimately providing better care for patients.

With all these trends and changes on the horizon, staying informed about **dental insurance options** is crucial for consumers. Understanding the nuances of different plans, coverage levels, and potential changes in policies can empower individuals to make better decisions regarding their oral health care.

As 2025 approaches, it’s advisable to regularly review your dental insurance plan, consider any changes in personal health needs, and stay updated on industry trends. Engaging with dental care providers and insurance representatives can also provide valuable insights into the most suitable options for your situation.

In conclusion, the landscape of **dental insurance in the USA** is set to undergo significant changes by 2025. By understanding current trends, policy changes, and future coverage options, individuals can navigate the complexities of dental insurance more effectively. Ultimately, being informed is key to making the best choices for your dental health and financial well-being.

As you prepare for the upcoming changes, consider reaching out to insurance professionals who can provide personalized advice and help you find the best dental insurance plan for your needs.

Top Trends in Health Insurance Plans in the USA 2025: Innovations and Changes Ahead

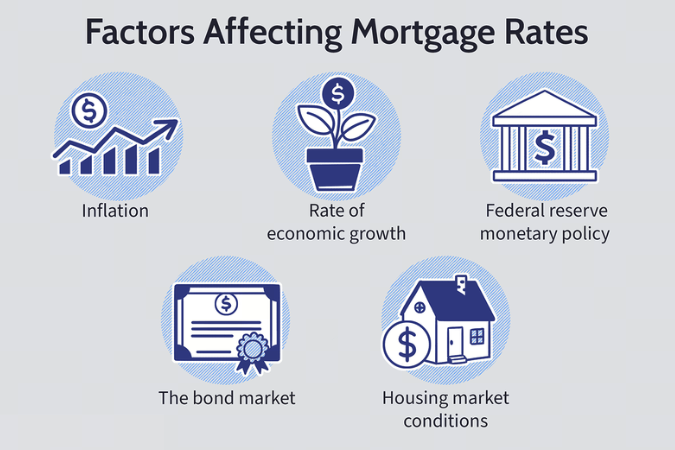

Impact of Economic Changes on Mortgage Loans in the USA: What to Expect in 2025

How Accident Attorneys are Adapting to Changes in Personal Injury Law by 2025

Changes in Personal Injury Legislation: What Attorneys Need to Know for 2025

Understanding Personal Injury Settlements: Trends and Predictions for 2025

The Impact of COVID-19 on Life Insurance Trends in the USA for 2025

The Future of Solar Roof Tiles in the USA: Trends and Innovations for 2025

Top Roofing Companies in the USA: Trends and Innovations to Watch in 2025