As we approach 2025, the landscape of health insurance in the USA is poised for significant transformation. Emerging trends highlight innovative coverage options, enhanced telehealth services, and a growing emphasis on personalized care. These changes reflect a shift towards more accessible, efficient, and patient-centered approaches, addressing the evolving needs of consumers in a dynamic healthcare environment.

As we look towards 2025, the landscape of health insurance plans in the USA is poised for significant transformation. With advancements in technology, changes in consumer expectations, and evolving regulations, several key trends are emerging that will shape the future of health insurance. Understanding these trends will not only help consumers make informed decisions but also assist providers in adapting to the changing market. Here are the top trends we can expect in health insurance plans in the USA by 2025.

In 2025, we will see a shift towards more **personalized health insurance plans**. Insurers are leveraging big data and analytics to tailor plans that meet the specific needs of individuals. This means that premiums, deductibles, and coverage options will be increasingly customized based on factors like age, health status, and lifestyle choices. The result will be a more user-centric approach that enhances customer satisfaction and reduces costs.

The COVID-19 pandemic accelerated the adoption of **telehealth services**, and this trend is expected to continue into 2025. Health insurance plans will increasingly cover virtual consultations, allowing patients to access healthcare providers from the comfort of their homes. This not only improves accessibility, particularly for those in rural areas, but also helps in reducing overall healthcare costs. Insurers are likely to offer incentives for using telehealth services, further promoting their use.

Health insurance providers are recognizing the value of **preventive care** in reducing long-term healthcare costs. By 2025, insurance plans will place a stronger emphasis on preventive services, such as wellness check-ups, vaccinations, and screenings. Many plans may offer zero-cost preventive services to encourage members to engage in healthier lifestyles, ultimately leading to better health outcomes and lower claims costs for insurers.

As awareness of mental health issues continues to grow, health insurance plans in 2025 will increasingly integrate **mental health services** into their offerings. Coverage for therapy sessions, counseling, and mental health resources will become more comprehensive and accessible. Insurers will recognize that addressing mental health is crucial for overall well-being, leading to improved member satisfaction and health outcomes.

Advancements in **artificial intelligence (AI)** and **machine learning** will revolutionize health insurance operations. These technologies will enable insurers to streamline claims processing, enhance fraud detection, and improve customer service through chatbots and virtual assistants. By 2025, AI will play a crucial role in identifying trends and predicting health risks, allowing insurers to proactively manage member health and create more effective insurance products.

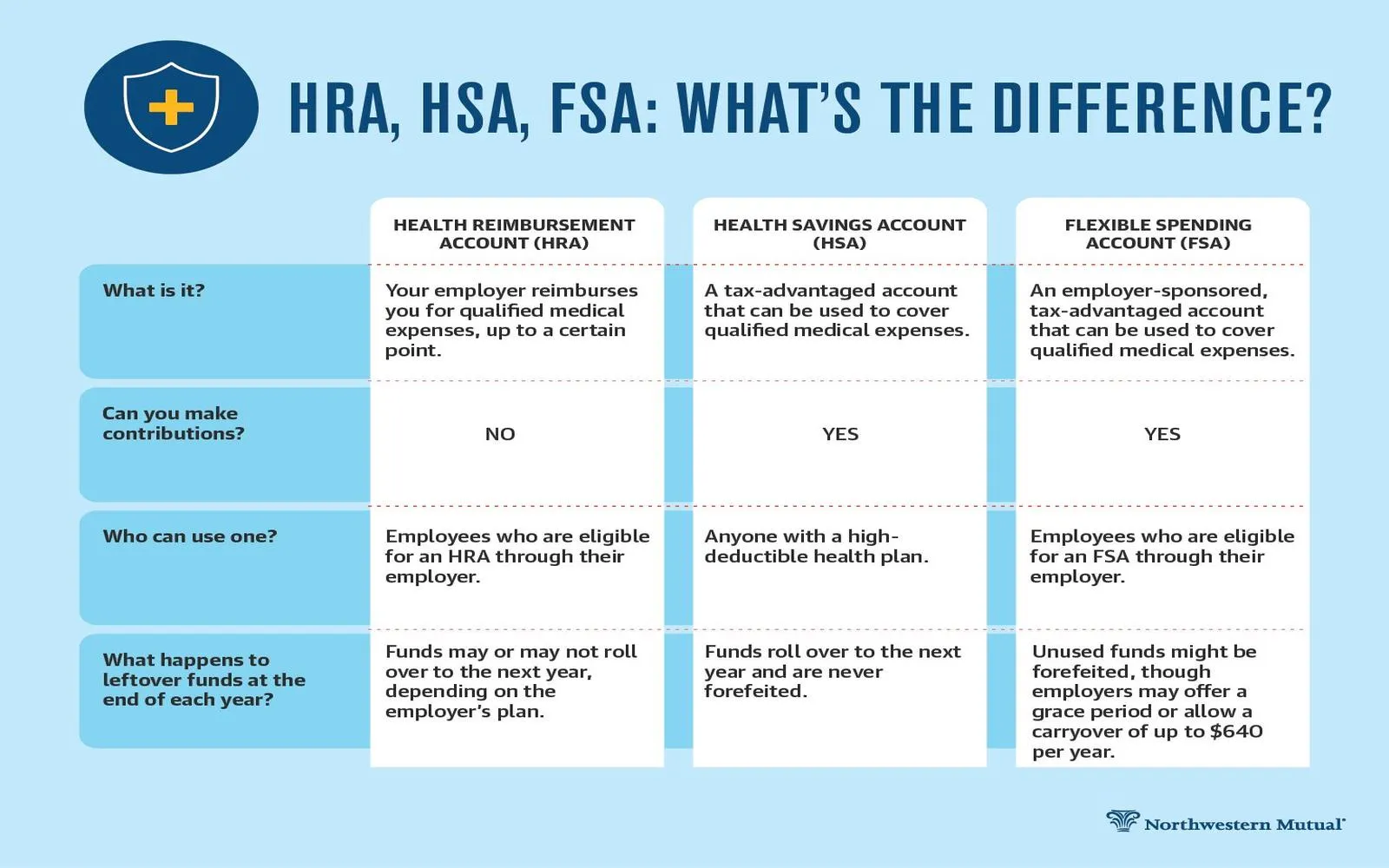

In recent years, there has been a growing interest in **Health Savings Accounts (HSAs)** and **Flexible Spending Accounts (FSAs)**. By 2025, these accounts will become more popular as consumers seek ways to manage out-of-pocket expenses. Insurers may offer more flexible options for HSAs and FSAs, allowing members to roll over funds or use them for a wider range of services, including wellness programs and alternative therapies.

The shift towards **value-based care models** will continue to gain momentum in 2025. Instead of focusing solely on the volume of services provided, insurers will increasingly reward healthcare providers based on patient outcomes and the quality of care delivered. This approach aims to improve the overall health of populations while controlling costs, aligning incentives for both providers and payers.

Consumers are demanding more transparency when it comes to healthcare costs, and health insurance plans will respond by providing clearer information on pricing and coverage. By 2025, we can expect insurers to offer tools and resources that help members understand their benefits, compare costs, and make informed decisions about their healthcare options. This trend toward **price transparency** will empower consumers and foster competition among providers.

As chronic diseases become increasingly prevalent, health insurance plans will place a greater emphasis on **chronic disease management** programs. By 2025, insurers will invest in resources and support for members with conditions like diabetes, hypertension, and asthma. These programs will provide education, monitoring, and access to specialized care, aimed at improving health outcomes and reducing healthcare costs.

Finally, the evolving regulatory landscape will significantly impact health insurance plans in 2025. Insurers will need to navigate new compliance requirements, including those related to data privacy, coverage mandates, and consumer protections. Staying abreast of these changes will be essential for insurers to ensure they remain competitive and compliant in a rapidly changing environment.

In conclusion, the health insurance landscape in the USA is set for substantial evolution by 2025. With trends focusing on personalization, technological advancements, preventive care, and enhanced transparency, both consumers and providers must adapt to these changes. Staying informed and proactive will be key to navigating the future of health insurance successfully.

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

Health Insurance Plans for Families in the USA 2025: Finding the Best Options for Your Needs

Best Health Insurance Plans in the USA (2025)

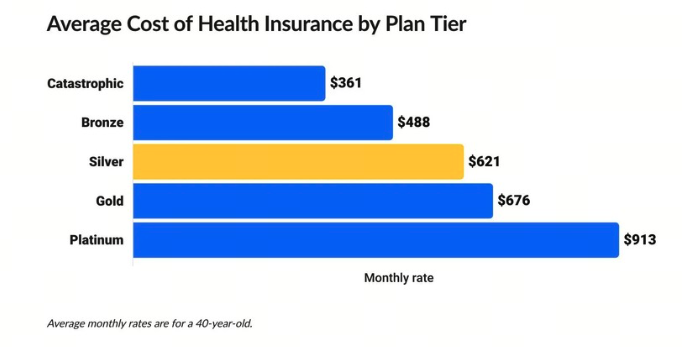

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

How to Choose the Right Health Insurance Plan in the USA 2025: Tips for Consumers

The Impact of Legislation on Health Insurance Plans in the USA 2025: What to Expect

Understanding Dental Insurance in the USA: Trends and Changes for 2025

The Future of Solar Roof Tiles in the USA: Trends and Innovations for 2025