Navigating the complex landscape of health insurance in the USA can be daunting, especially with changing regulations and options. This guide offers essential tips for consumers in 2025, helping you understand key factors to consider when selecting a health insurance plan. From evaluating coverage options to assessing costs, make informed decisions to secure the best health care for you and your family.

Choosing the right health insurance plan in the USA can feel overwhelming, especially with the numerous options available in 2025. Understanding the key factors that influence your decision will help you make an informed choice that fits your needs and budget. Here are some essential tips for consumers looking to navigate the health insurance landscape.

Before diving into the different health insurance plans, it's crucial to assess your healthcare needs. Consider the following:

By understanding your healthcare needs, you can better evaluate which plans provide the coverage necessary for your situation.

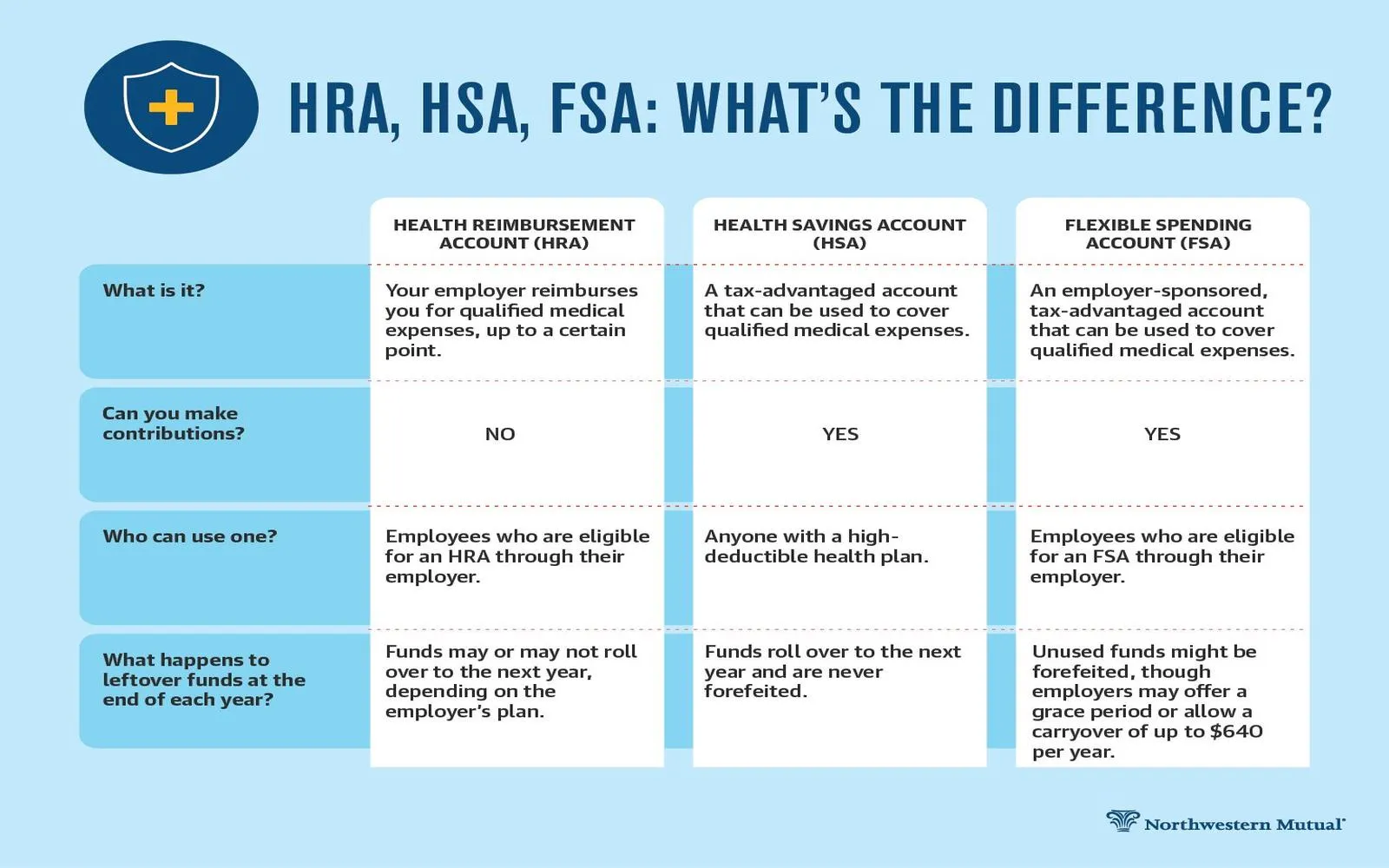

Health insurance can be filled with complex terminology. Here are some key terms to know:

Understanding these terms will empower you to compare plans effectively.

In 2025, there are several types of health insurance plans available. Each type has its pros and cons, so consider your preferences:

Choose a plan type that aligns with your healthcare usage and financial situation.

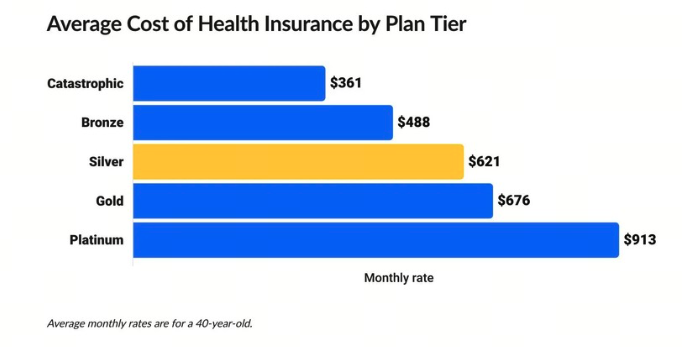

When evaluating health insurance plans, it's essential to compare both costs and coverage:

Creating a spreadsheet can help you visualize the costs and benefits of different plans side by side.

Some health insurance plans offer additional benefits that can enhance your overall healthcare experience. Consider the following:

These added benefits can significantly improve your health and well-being.

In 2025, numerous online resources and tools can aid you in selecting the right health insurance plan:

These tools can simplify the decision-making process and provide clarity on your choices.

If you still feel unsure about choosing a health insurance plan, don’t hesitate to seek assistance. You can:

Getting expert advice can help clarify your options and lead you to the best decision.

Selecting the right health insurance plan in the USA for 2025 requires careful consideration of various factors. By understanding your healthcare needs, familiarizing yourself with key terms, evaluating plan types, comparing costs and benefits, and utilizing available resources, you will be well-equipped to make an informed decision. Remember, the right health insurance plan can have a significant impact on your health and financial well-being.

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Top Trends in Health Insurance Plans in the USA 2025: Innovations and Changes Ahead

The Impact of Legislation on Health Insurance Plans in the USA 2025: What to Expect

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

Health Insurance Plans for Families in the USA 2025: Finding the Best Options for Your Needs

Best Health Insurance Plans in the USA (2025)

How to Choose the Best Life Insurance Plan in the USA: 2025 Insights

How to Choose the Right Online Master’s Degree Program in the USA for Your Career Goals in 2025