The COVID-19 pandemic has significantly reshaped the life insurance landscape in the USA, leading to evolving consumer behaviors and heightened awareness of financial security. As we approach 2025, trends such as increased demand for digital services, shifts in policy preferences, and a focus on health-related coverage will redefine how insurers operate and engage with clients in a post-pandemic world.

The COVID-19 pandemic has significantly reshaped many industries, including the **life insurance** sector in the United States. As we approach 2025, it's essential to analyze the long-term impacts of the pandemic on **life insurance trends**. This analysis reveals shifts in consumer behavior, regulatory changes, and the adoption of technology that will define the future of life insurance.

Before the pandemic, many individuals viewed **life insurance** as an optional expense. However, the uncertainties brought about by COVID-19 have led to a growing awareness of its importance. A survey conducted in late 2020 indicated that nearly 50% of respondents were considering purchasing **life insurance** for the first time, reflecting a significant shift in consumer attitudes.

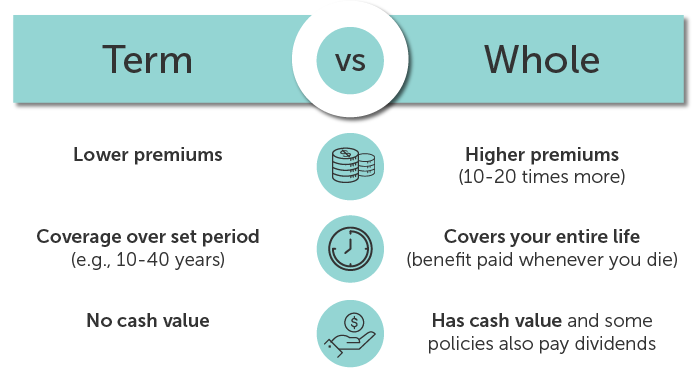

This trend is expected to continue into 2025, as more people recognize the importance of financial security for their families. The desire for **financial protection** has encouraged consumers to explore various policy options, leading to an increase in demand for both term and permanent life insurance products.

The pandemic has also brought health to the forefront of consumers' minds. There is a growing emphasis on living a healthier lifestyle, which can directly impact **life insurance premiums**. Insurers are increasingly using health data to assess risk and set premium rates. Additionally, many providers are offering incentives for policyholders to maintain a healthy lifestyle, such as discounts for regular health check-ups and wellness program participation.

By 2025, we anticipate that policies will more frequently incorporate health maintenance components, encouraging policyholders to engage in preventive care. This shift not only benefits the insured but also allows insurers to manage their risk more effectively.

The adoption of technology has accelerated in the **life insurance** industry due to the pandemic. More companies are investing in digital platforms to enhance customer experience, streamline processes, and improve accessibility. By 2025, we can expect significant advancements in the use of artificial intelligence (AI) and machine learning in underwriting and claims processing.

These technologies will enable insurers to evaluate applications more accurately and quickly. For instance, AI can analyze vast amounts of data to determine risk factors, while machine learning algorithms can predict customer behavior and preferences. This shift towards automation will not only reduce operational costs but also improve customer satisfaction.

The pandemic has prompted regulators to reassess existing policies and adapt to the evolving landscape. In the coming years, we expect to see new regulations aimed at enhancing consumer protection and ensuring transparency in the **life insurance** market. For instance, there may be stricter guidelines on how companies assess risk and set premium rates.

Insurers will need to be more proactive in complying with these regulations, which may lead to increased operational costs. However, these changes can ultimately benefit consumers by promoting fair practices and encouraging competition within the industry.

As consumers adapt to a more digital lifestyle, the trend of purchasing **life insurance** online is surging. The convenience of online applications and the availability of instant quotes have made it easier for consumers to compare policies. By 2025, we predict that a significant portion of life insurance sales will occur through digital channels, driven by the demand for immediacy and ease of use.

Insurers will need to invest in user-friendly websites and mobile applications to capture this market. Furthermore, the rise of online sales will necessitate robust digital marketing strategies to reach potential customers effectively.

The impact of COVID-19 on life insurance trends in the USA is profound and far-reaching. As we look towards 2025, we see a landscape shaped by changing consumer attitudes, a heightened focus on health, technological advancements, regulatory changes, and the rise of online sales. Insurers that adapt to these trends will be better positioned to meet the evolving needs of consumers.

In summary, the **life insurance** industry is on the brink of transformation, and understanding these trends is crucial for both consumers and providers. By embracing the changes brought about by the pandemic, the industry can offer better services, products, and ultimately, peace of mind to policyholders.

Top Life Insurance Plans in the USA for 2025: A Comprehensive Guide

Understanding the Benefits of Term vs. Whole Life Insurance in 2025

How to Choose the Best Life Insurance Plan in the USA: 2025 Insights

Affordable Life Insurance Plans: What You Need to Know in 2025

Navigating Life Insurance for Seniors: Best Plans in the USA for 2025"

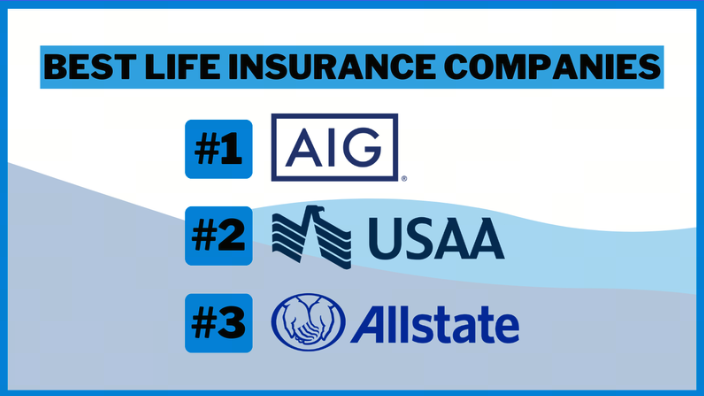

Best Life Insurance Plans in the USA in 2025

The Impact of Climate Change on Roofing Trends in the USA: Insights for 2025

The Impact of Tax Deductions on Donation Trends in the USA: A 2025 Perspective