As seniors approach their golden years, understanding life insurance options becomes crucial. This guide explores the best life insurance plans available in the USA for 2025, tailored specifically for older adults. Discover essential insights on coverage types, affordability, and key factors to consider, ensuring you make informed decisions that protect your legacy and provide peace of mind for your loved ones.

Life insurance is an essential financial tool, especially for seniors looking to secure their family's financial future. In 2025, the landscape of life insurance for seniors in the USA is evolving, with various plans tailored to meet the unique needs of older adults. Understanding these options can help you make informed decisions about your financial security.

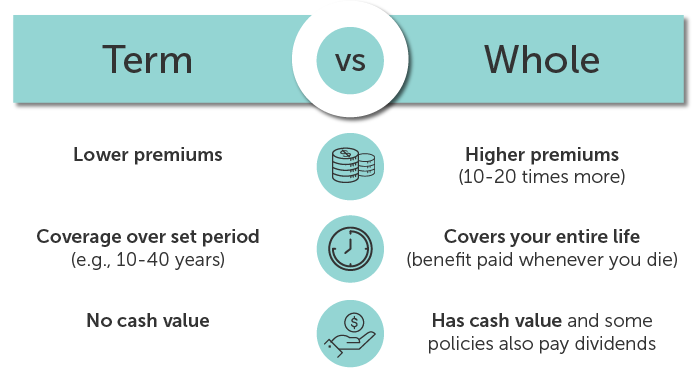

When considering life insurance, seniors typically have two primary options: **term life insurance** and **permanent life insurance**. Each has its advantages and disadvantages, which are important to understand.

**Term life insurance** provides coverage for a specific period, usually ranging from 10 to 30 years. This type of policy is often more affordable, making it an attractive option for seniors who need coverage for a limited time, such as until their mortgage is paid off or until their children are financially independent.

**Permanent life insurance**, which includes whole life and universal life policies, offers coverage for the insured's entire lifetime, as long as premiums are paid. These plans often accumulate cash value, which can be tapped into during the policyholder's lifetime, making them a good option for seniors who want a more comprehensive financial strategy.

As of 2025, several life insurance companies are known for their competitive offerings tailored specifically for seniors. Below is a chart summarizing some of the best plans available in the USA:

| Insurance Company | Type of Plan | Age Limits | Average Monthly Premium |

|---|---|---|---|

| Mutual of Omaha | Whole Life | 45-85 | $80 |

| John Hancock | Term Life | 50-75 | $65 |

| State Farm | Universal Life | 50-80 | $90 |

| Prudential | Term Life | 50-85 | $75 |

| New York Life | Whole Life | 50-85 | $85 |

When selecting the best life insurance plan, seniors should consider several factors:

Your **health status** plays a significant role in determining your eligibility and premium rates. Most insurers will require a medical exam or may use a simplified underwriting process for seniors. It's important to assess your health and shop around for the best rates.

Determine how much coverage you need. This often depends on your financial obligations, such as debts and living expenses, as well as your family's future needs. A good rule of thumb is to have coverage that is at least 10-15 times your annual income.

Look for **policy features** that suit your needs. Some plans offer additional benefits, such as accelerated death benefits, which allow you to access a portion of the death benefit if you are diagnosed with a terminal illness.

Ensure that the premiums fit within your budget. While it may be tempting to opt for a lower premium, it’s essential to consider the long-term costs and whether the policy will remain affordable as you age.

Before committing to a plan, it's crucial to **compare quotes** from multiple insurance providers. Different companies may offer varying rates and policy features, and taking the time to research can lead to significant savings.

Navigating **life insurance for seniors** in 2025 may seem daunting, but understanding your options can empower you to make the right choice. By considering factors like health, coverage needs, and affordability, you can find a plan that secures your financial future and provides peace of mind for you and your loved ones. Remember, the best time to invest in life insurance is now, ensuring that you are prepared for whatever life may bring.

Top Life Insurance Plans in the USA for 2025: A Comprehensive Guide

Understanding the Benefits of Term vs. Whole Life Insurance in 2025

How to Choose the Best Life Insurance Plan in the USA: 2025 Insights

The Impact of COVID-19 on Life Insurance Trends in the USA for 2025

Affordable Life Insurance Plans: What You Need to Know in 2025

Best Life Insurance Plans in the USA in 2025

Best Health Insurance Plans in the USA (2025)

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options