As the U.S. economy evolves, fluctuations in interest rates, inflation, and employment levels are poised to significantly influence the mortgage loan landscape. By 2025, potential homebuyers and current homeowners may face new challenges and opportunities. Understanding these economic changes will be crucial for making informed decisions about financing and purchasing property in an ever-shifting market.

The economic landscape in the United States is continually evolving, and these changes significantly impact various sectors, particularly the mortgage loan market. As we look toward 2025, understanding the **impact of economic changes on mortgage loans** is crucial for prospective homebuyers, investors, and industry professionals. This article delves into how shifts in the economy may shape mortgage interest rates, lending standards, and housing demand in the coming years.

To anticipate the future of mortgage loans, we first need to examine current economic indicators. Factors such as inflation, unemployment rates, and GDP growth directly influence the mortgage market. As of 2023, the U.S. economy has shown signs of recovery from the pandemic, but inflation remains a concern, with rates hovering around 3%-4%.

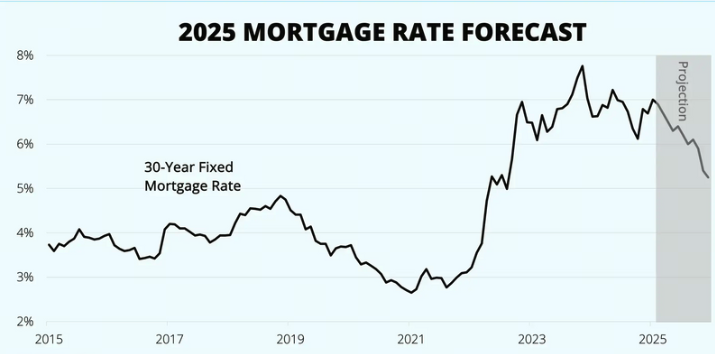

**Interest rates** are a critical component in this equation. The Federal Reserve has been adjusting rates to combat inflation, which in turn affects the cost of borrowing. As we approach 2025, the Fed's decisions will be paramount in determining mortgage rates. If inflation persists, we might see continued increases in rates, leading to more expensive **mortgage loans**.

Interest rates are perhaps the most significant factor influencing the **mortgage loan market**. Higher rates generally lead to lower affordability for buyers, which can cool down housing demand. Conversely, lower rates can stimulate the market by making loans more accessible.

In 2025, if the Federal Reserve opts to maintain higher interest rates to control inflation, potential homebuyers may face challenges. For instance, if the average **30-year fixed mortgage rate** rises to 6% or 7%, many first-time buyers may be priced out of the market. This could lead to a slowdown in home sales and a potential decrease in home prices.

Another aspect to consider is the potential tightening of **lending standards**. During periods of economic uncertainty, lenders often become more cautious, requiring higher credit scores and larger down payments. If economic indicators signal instability, we might see a stricter approach to mortgage approvals.

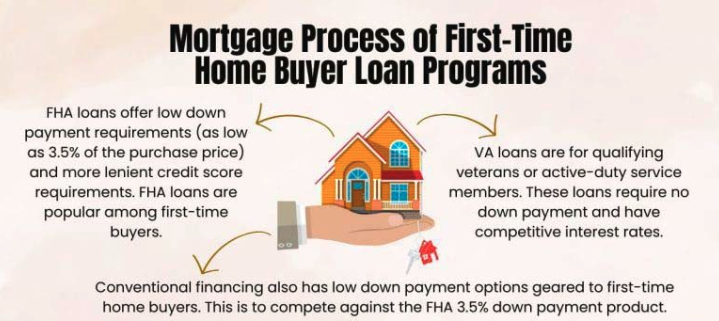

In 2025, prospective buyers with lower credit scores or limited savings may find it harder to secure loans. This could disproportionately affect first-time homebuyers and those with less financial stability. However, if the economy stabilizes and inflation is under control, lenders may become more lenient, easing access to **mortgage loans**.

The relationship between economic conditions and housing demand is complex. A robust economy typically leads to increased demand for housing, as more individuals can afford to buy homes. Conversely, economic downturns can lead to a decrease in demand, as people become more hesitant to make significant financial commitments.

As we look to 2025, if the economy continues to grow and job opportunities increase, we may see a rise in demand for homes. However, if high interest rates persist, this demand may be tempered. The **housing market** could witness a situation where demand remains high, but affordability issues limit the number of potential buyers.

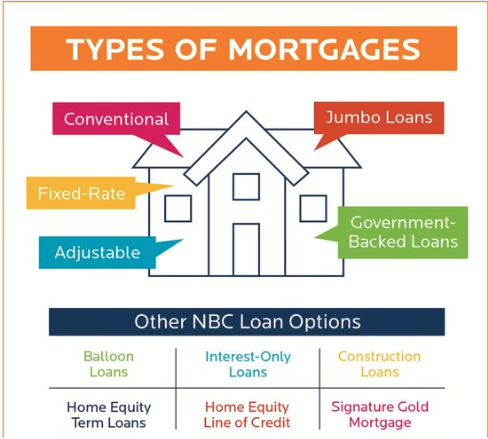

Innovation in mortgage products may also emerge in response to economic changes. As the market evolves, lenders may introduce new loan options to accommodate varying financial situations. For example, adjustable-rate mortgages (ARMs) may become more popular if fixed rates remain high, allowing borrowers to take advantage of lower initial rates.

In addition, programs aimed at assisting first-time buyers, such as down payment assistance or shared equity mortgages, may gain traction. These products could help bridge the gap created by higher rates and stricter lending standards, making homeownership more attainable.

As we look forward to 2025, it’s essential to stay informed about the **impact of economic changes on mortgage loans**. While we cannot predict the future with certainty, understanding the current economic indicators and trends can help buyers and investors make informed decisions. By staying aware of potential interest rate fluctuations, lending standards, and housing demand, individuals can better navigate the mortgage landscape.

In summary, potential homebuyers should prepare for a dynamic market influenced by economic changes. Whether you’re planning to purchase a home or invest in real estate, being proactive and informed will help you adapt to whatever the future holds in the mortgage loan space.

Mortgage Rate Projections 2023 5.0% 2024 5.5% 2025 6.0%-7.0%

Understanding Mortgage Loan Types in the USA: A Comprehensive Guide for 2025

How to Secure the Best Mortgage Loan Rates in the USA for 2025

Navigating the Mortgage Loan Process in the USA: Tips for First-Time Homebuyers in 2025

The Future of Mortgage Loans in the USA: Trends to Watch in 2025

Innovations in Mortgage Loans: Exploring Technology’s Role in the USA by 2025".

Best Mortgage Loans in the USA 2025: A Comprehensive Guide

The Impact of Technology on Small Business Loans: What to Expect in 2025

The Impact of Legislation on Health Insurance Plans in the USA 2025: What to Expect