Navigating the mortgage landscape can be daunting, especially with fluctuating interest rates. In 2025, securing the best mortgage loan rates in the USA requires strategic planning and informed decisions. This guide will provide essential tips and insights to help you understand market trends, improve your credit score, and choose the right lender, ensuring you get the most favorable terms for your home loan.

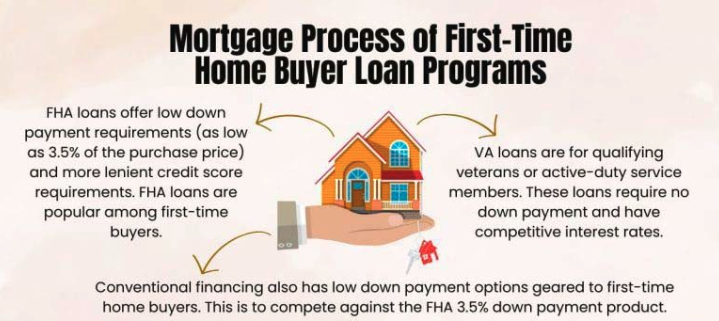

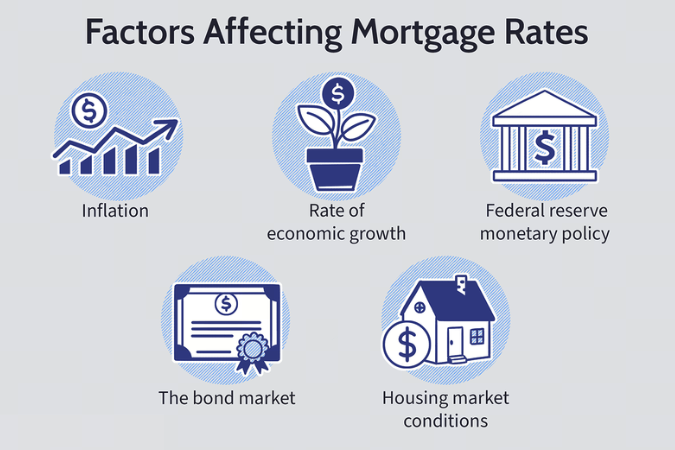

When looking for the best mortgage loan rates in the USA for 2025, it's essential to understand what influences these rates. Mortgage rates are primarily affected by the economic environment, including inflation, the Federal Reserve's interest rate decisions, and overall demand for housing. By grasping these factors, you can better position yourself to secure a favorable rate.

Your credit score is one of the most critical factors in determining your mortgage loan rate. Lenders typically offer lower rates to borrowers with higher credit scores, as they are seen as less risky. To secure the best mortgage loan rates in 2025, aim for a credit score of 740 or higher. Check your credit report for any discrepancies and take steps to improve your score if necessary. This may include paying down debt, making timely payments, and avoiding new credit inquiries.

Don't settle for the first mortgage offer you receive. It's vital to shop around and compare offers from multiple lenders. Different lenders have varying rates and terms, and even a small difference in interest can save you thousands over the life of the loan. Use online mortgage comparison tools to get quotes and ensure you’re getting the best deal. Remember to consider other fees, such as closing costs and points, which can impact your overall expenses.

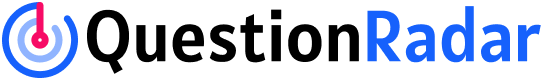

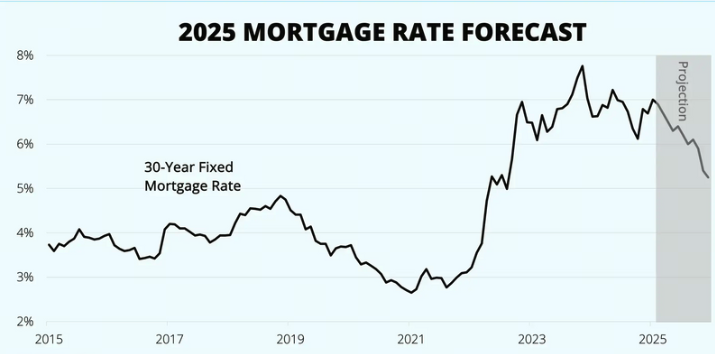

Understanding the various types of mortgage loans can help you choose the right one for your financial situation. Common options include:

Evaluate which loan type best meets your needs and compares rates accordingly.

Once you find a favorable rate, consider locking it in. A rate lock guarantees your mortgage rate for a specified period, protecting you from potential increases while your loan is being processed. Rate locks can vary in length, so ensure you understand the terms. A lock may be especially beneficial in a rising interest rate environment, where rates are expected to increase.

Your debt-to-income (DTI) ratio is another crucial factor lenders consider when determining your mortgage loan rate. This ratio measures how much of your monthly income goes toward paying debts. A lower DTI ratio demonstrates to lenders that you have a good handle on your finances, making you a more attractive borrower. Aim for a DTI ratio below 36% to improve your chances of securing the best rates.

Making a larger down payment can significantly impact your mortgage loan rate. A down payment of 20% or more can help you avoid private mortgage insurance (PMI) costs and may qualify you for lower rates. If you can save up for a more substantial down payment, it can lead to significant savings over the life of your loan.

Keeping an eye on economic indicators can help you anticipate changes in mortgage rates. Monitor inflation rates, employment statistics, and the actions of the Federal Reserve. Understanding these trends will allow you to time your mortgage application effectively and potentially secure lower rates.

If navigating the mortgage landscape seems overwhelming, consider working with a mortgage broker. Brokers have access to multiple lenders and can help you find the best rates based on your specific financial situation. They can also assist with the paperwork and negotiations, ensuring you get the best deal possible.

Finally, be aware of the closing costs associated with obtaining a mortgage. These costs can range from 2% to 5% of the loan amount and include fees for appraisals, inspections, and other services. While these costs don't directly affect your interest rate, they impact the overall affordability of your mortgage. Budget for these expenses to ensure you can secure the best mortgage loan rates without financial strain.

Securing the best mortgage loan rates in the USA for 2025 requires careful planning and strategic decision-making. By understanding your credit score, shopping around, exploring different loan types, and being informed about market trends, you can enhance your chances of obtaining favorable rates. With the right preparation, you can make your homeownership dreams a reality.

| Loan Type | Average Rate (%) | Notes |

|---|---|---|

| Fixed-rate mortgage | 3.5% | Stable payments over the life of the loan. |

| Adjustable-rate mortgage (ARM) | 2.8% | Lower initial rates but may increase over time. |

| FHA loan | 3.3% | Lower down payment options available. |

| VA loan | 3.0% | No down payment required for qualifying veterans. |

Navigating the Mortgage Loan Process in the USA: Tips for First-Time Homebuyers in 2025

The Future of Mortgage Loans in the USA: Trends to Watch in 2025

Best Mortgage Loans in the USA 2025: A Comprehensive Guide

Understanding Mortgage Loan Types in the USA: A Comprehensive Guide for 2025

Impact of Economic Changes on Mortgage Loans in the USA: What to Expect in 2025

Innovations in Mortgage Loans: Exploring Technology’s Role in the USA by 2025".

Best Mesothelioma Lawyers in the USA 2025: Success Rates and Client Testimonials

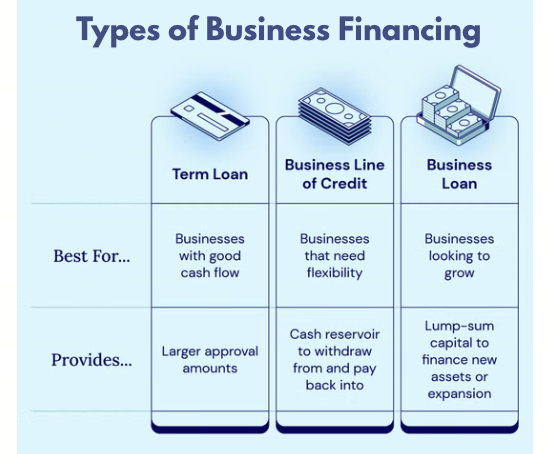

Comparing Small Business Loan Options in the USA: 2025 Edition