Buying your first home can be both exciting and overwhelming, especially in the evolving landscape of the mortgage market in 2025. This guide provides essential tips for first-time homebuyers, helping you navigate the mortgage loan process with confidence. From understanding loan options to preparing your finances, we aim to simplify your journey toward homeownership.

Buying a home for the first time can be both exciting and overwhelming, especially in an evolving market like the USA in 2025. Understanding the mortgage loan process is essential for first-time homebuyers to make informed decisions. This article provides valuable tips to help you navigate the mortgage loan process effectively.

The mortgage loan process consists of several key steps that can vary in duration and complexity. Familiarizing yourself with these steps can streamline your journey to homeownership. Here are the essential stages:

To help you navigate the mortgage loan process smoothly, consider these essential tips:

Your credit score plays a significant role in determining your mortgage interest rates and eligibility. Before applying for a mortgage, check your credit report for errors and take steps to improve your score. Pay down debts, avoid new credit inquiries, and make timely payments to enhance your credit profile.

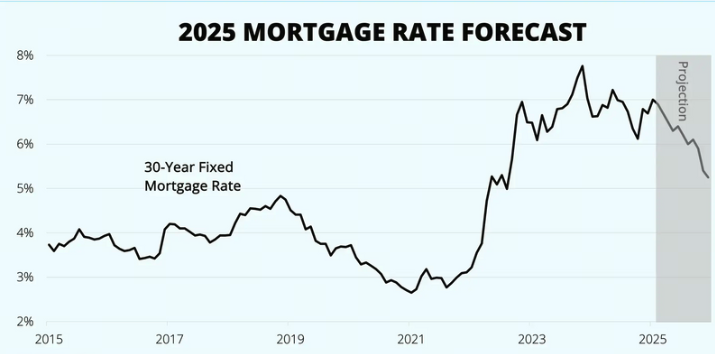

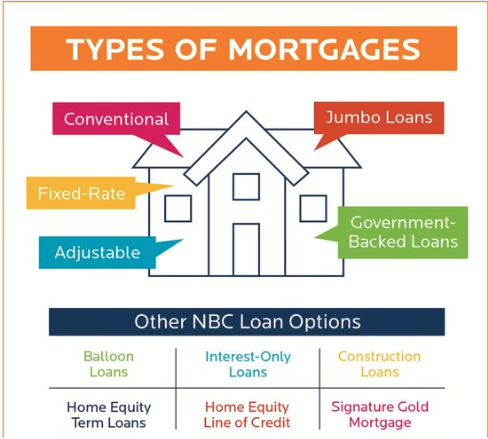

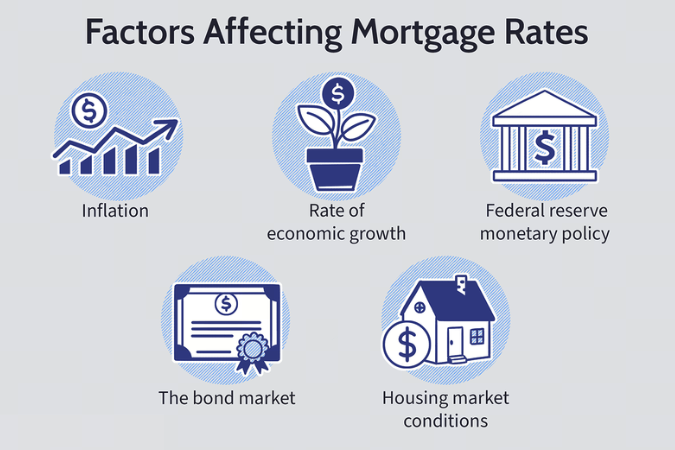

20% down payment, many lenders offer options with lower down payments. Explore programs for first-time homebuyers that may allow you to put down as little as 3% or 5%. However, saving more will lower your monthly payments and eliminate private mortgage insurance (PMI). 3. Research Different Loan Types Familiarize yourself with various mortgage loan types available in 2025, including fixed-rate, adjustable-rate, FHA, VA, and USDA loans. Each type has unique requirements and benefits, so choose one that aligns with your financial situation and long-term goals. 4. Compare Lenders Don't settle for the first lender you encounter. Shop around and compare interest rates, fees, and loan terms from multiple lenders. Even a slight difference in interest rates can significantly impact your overall payment. Utilize online tools to facilitate your search and ensure you get the best deal. 5. Budget for Additional Costs In addition to your mortgage payment, remember to budget for other homeownership costs such as property taxes, homeowners insurance, maintenance, and utilities. Having a comprehensive budget will help you avoid financial strain after purchasing your home. Understanding Mortgage Rates in 2025 The mortgage rates in 2025 may fluctuate based on economic conditions, so it's essential to stay informed. Keep an eye on the Federal Reserve's interest rate policies, as they can influence mortgage rates. Consider locking in your rate if you find a favorable one, as this can protect you from future increases. The Importance of Home Inspections Before finalizing your purchase, invest in a thorough home inspection. This process identifies potential issues that could lead to costly repairs down the line. Addressing these issues before closing can save you money and provide peace of mind. Utilizing Real Estate Professionals Consider working with a qualified real estate agent who understands the local market. An experienced agent can guide you through the home-buying process, negotiate on your behalf, and provide valuable insights into the areas you’re considering. Additionally, a mortgage broker can help you find the best loan options tailored to your needs. Final Thoughts Navigating the mortgage loan process as a first-time homebuyer in the USA in 2025 may seem daunting, but with the right preparation and knowledge, it can be a rewarding experience. By following these tips, you’ll be well on your way to securing the home of your dreams. Remember to stay organized, do your research, and seek professional guidance when necessary. Happy house hunting!

The Future of Mortgage Loans in the USA: Trends to Watch in 2025

Understanding Mortgage Loan Types in the USA: A Comprehensive Guide for 2025

How to Secure the Best Mortgage Loan Rates in the USA for 2025

Impact of Economic Changes on Mortgage Loans in the USA: What to Expect in 2025

Innovations in Mortgage Loans: Exploring Technology’s Role in the USA by 2025".

Best Mortgage Loans in the USA 2025: A Comprehensive Guide

Mobile-First Advertising: Adapting Strategies for the USA Market in 2025

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs