Navigating the world of mortgage loans can be daunting, especially with the variety of options available. This comprehensive guide for 2025 breaks down the different types of mortgage loans in the USA, providing essential insights into fixed-rate, adjustable-rate, FHA, VA, and jumbo loans. Empower yourself with the knowledge needed to make informed decisions and secure the best financing for your home.

When it comes to securing a home in the USA, understanding the various **mortgage loan types** is crucial. Each type of mortgage has its own set of features, benefits, and eligibility criteria. In this comprehensive guide for 2025, we will explore the most common **mortgage options**, helping you make an informed decision tailored to your financial needs.

A **fixed-rate mortgage** is one of the most popular types of home loans in the USA. As the name suggests, the interest rate on a fixed-rate mortgage remains unchanged throughout the life of the loan, typically 15, 20, or 30 years. This stability makes budgeting easier for homeowners, as monthly payments remain consistent.

**Advantages of Fixed-Rate Mortgages**:

**Disadvantages of Fixed-Rate Mortgages**:

**Adjustable-rate mortgages** (ARMs) come with lower initial interest rates compared to fixed-rate loans. However, the rate is subject to change after an initial fixed period, which can range from 1 to 10 years. Once the initial period ends, the interest rate adjusts periodically based on market conditions.

**Advantages of ARMs**:

**Disadvantages of ARMs**:

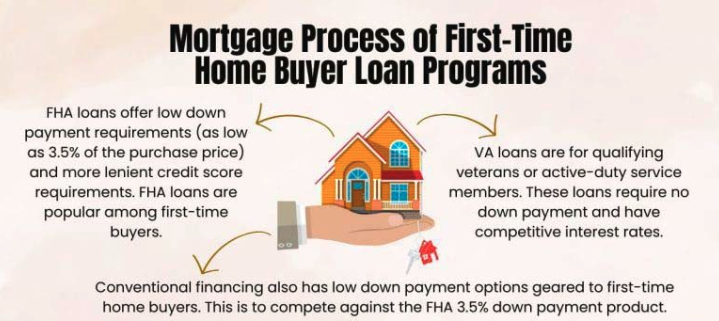

Government-backed loans are designed to help specific groups of homebuyers, such as first-time buyers, veterans, or low-income individuals. The most common types include:

**FHA loans** are backed by the Federal Housing Administration and are popular among first-time homebuyers due to their lower down payment requirements (as low as 3.5%). They are also more lenient on credit scores.

**VA loans** are available to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. They offer several benefits, including no down payment, no private mortgage insurance (PMI), and competitive interest rates.

**USDA loans** are designed for rural homebuyers and are backed by the U.S. Department of Agriculture. They typically require no down payment and have lower mortgage insurance costs, making them an attractive option for those looking to purchase in designated rural areas.

**Jumbo loans** are non-conforming loans that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are typically used for high-value properties and come with stricter credit requirements and higher interest rates.

**Advantages of Jumbo Loans**:

**Disadvantages of Jumbo Loans**:

With **interest-only mortgages**, borrowers only pay the interest on the loan for a specified period, usually 5 to 10 years. After this period, monthly payments increase significantly as the borrower begins to pay off the principal.

**Advantages of Interest-Only Mortgages**:

**Disadvantages of Interest-Only Mortgages**:

Choosing the right **mortgage loan type** depends on various factors, including your financial situation, plans for home ownership, and risk tolerance. Here are a few tips for making the right choice:

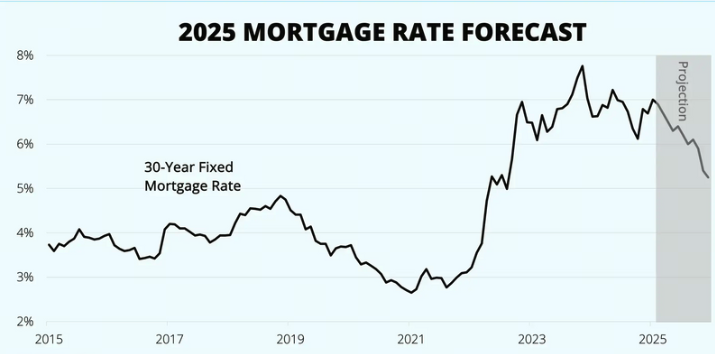

Understanding the different **mortgage loan types** available in the USA is essential for making informed home-buying decisions. Whether you opt for a **fixed-rate mortgage**, an **ARM**, or a government-backed loan, each option has its benefits and drawbacks. Take the time to evaluate your financial circumstances and long-term goals to find the best mortgage solution for you in 2025.

The Future of Mortgage Loans in the USA: Trends to Watch in 2025

How to Secure the Best Mortgage Loan Rates in the USA for 2025

Navigating the Mortgage Loan Process in the USA: Tips for First-Time Homebuyers in 2025

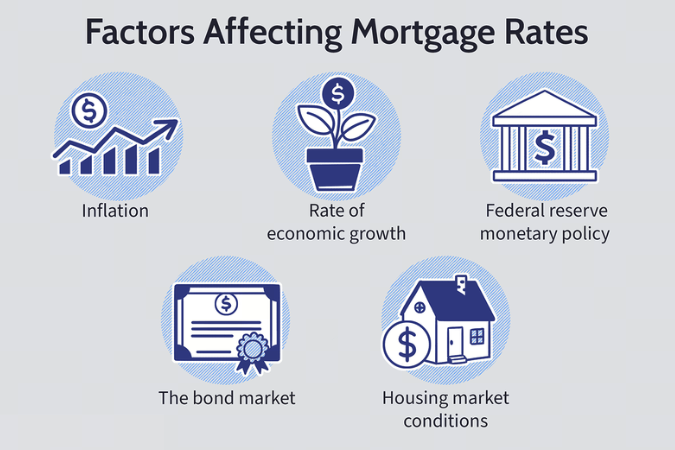

Impact of Economic Changes on Mortgage Loans in the USA: What to Expect in 2025

Innovations in Mortgage Loans: Exploring Technology’s Role in the USA by 2025".

Best Mortgage Loans in the USA 2025: A Comprehensive Guide

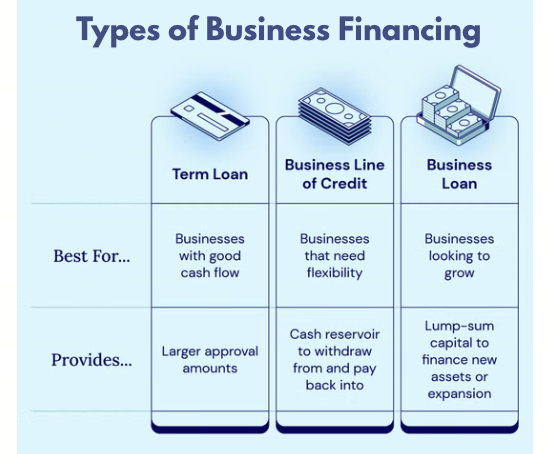

Comparing Small Business Loan Options in the USA: 2025 Edition

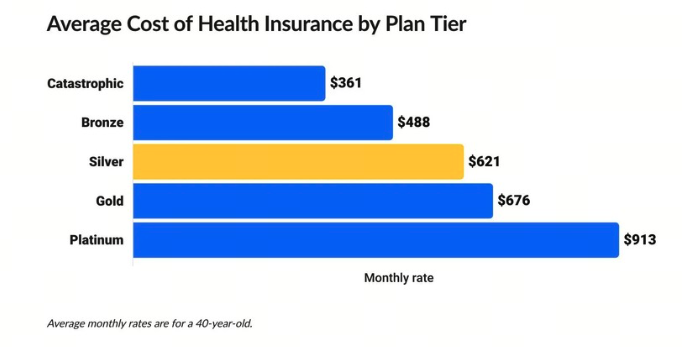

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know