As the mortgage industry evolves, technology is set to revolutionize the way loans are originated, processed, and managed in the USA by 2025. This exploration delves into innovative solutions such as AI, blockchain, and digital platforms, highlighting their potential to enhance efficiency, improve customer experiences, and create a more accessible and transparent mortgage landscape for borrowers and lenders alike.

The mortgage industry in the USA is undergoing a significant transformation as we approach 2025, driven by innovations in technology. These advancements are not only streamlining processes but also enhancing customer experience. In this article, we will explore the various technological innovations that are reshaping mortgage loans and their impact on borrowers and lenders alike.

One of the most notable innovations in the mortgage industry is the rise of digital mortgage platforms. These platforms allow borrowers to complete the entire mortgage application process online, from pre-approval to closing. Companies like Better.com and Rocket Mortgage have pioneered this approach, making it easier for consumers to navigate the often-complex mortgage landscape.

By leveraging technology, these platforms offer a user-friendly interface and quick access to essential documents, reducing the time it takes to secure a mortgage. As a result, borrowers can expect a faster and more efficient experience, with many approvals being granted within minutes rather than days.

Artificial intelligence (AI) and machine learning are playing a pivotal role in the evolution of mortgage loans. Lenders are increasingly using AI algorithms to assess creditworthiness and risk factors more accurately. This technology analyzes vast amounts of data from various sources, including social media and payment histories, to provide a more comprehensive view of a borrower’s financial health.

Moreover, AI can help identify potential fraud by flagging unusual patterns or discrepancies in applications. This innovation not only enhances security but also speeds up the approval process, enabling lenders to make more informed decisions rapidly.

Blockchain technology is another groundbreaking innovation set to revolutionize the mortgage industry. By offering a decentralized and transparent ledger system, blockchain can streamline property transactions and reduce the need for intermediaries. This technology ensures that all parties involved in a mortgage transaction have access to the same information, increasing trust and reducing the potential for disputes.

In addition, blockchain can simplify the process of title transfers and ensure that all relevant documents are securely stored and easily accessible. As more lenders and real estate professionals adopt blockchain, we can expect to see a significant reduction in closing times and associated costs.

The use of virtual reality (VR) and augmented reality (AR) in the mortgage process is gaining traction as well. These technologies allow potential homebuyers to experience properties in immersive environments without having to visit them physically. Virtual tours can provide a realistic sense of a home’s layout and design, making it easier for buyers to make informed decisions.

Additionally, AR applications can assist in visualizing renovations or changes to a property, helping buyers envision their future home. This innovation is particularly beneficial in a competitive market, where making quick decisions is crucial.

Customer service is vital in the mortgage industry, and the introduction of chatbots has transformed how lenders interact with borrowers. These AI-powered tools can provide instant responses to common inquiries, guiding users through the mortgage process and answering questions about interest rates, eligibility, and documentation.

By offering 24/7 support, chatbots enhance the overall customer experience and free up human agents to handle more complex issues. As these tools become increasingly sophisticated, they will be able to provide personalized advice based on individual borrower profiles, further improving service quality.

The adoption of e-signatures and digital document management systems is another critical innovation in mortgage loans. These technologies allow borrowers to sign documents electronically, eliminating the need for physical paperwork. This not only speeds up the closing process but also reduces the environmental impact associated with printing and filing documents.

Digital document management systems ensure that all necessary paperwork is organized and easily accessible, reducing the risk of lost documents or delays due to missing information. As these systems become more integrated into the mortgage process, borrowers can expect a smoother and more efficient experience.

As we look ahead to 2025, it is clear that innovations in technology will continue to shape the mortgage industry in the USA. From digital mortgage platforms and AI-driven assessments to blockchain and enhanced customer service through chatbots, these advancements are making the mortgage process faster, more efficient, and more accessible for borrowers.

By embracing these technologies, lenders can not only improve their operational efficiency but also provide a superior experience for their clients. As the industry evolves, staying informed about these trends will be crucial for both borrowers and lenders alike.

The Future of Mortgage Loans in the USA: Trends to Watch in 2025

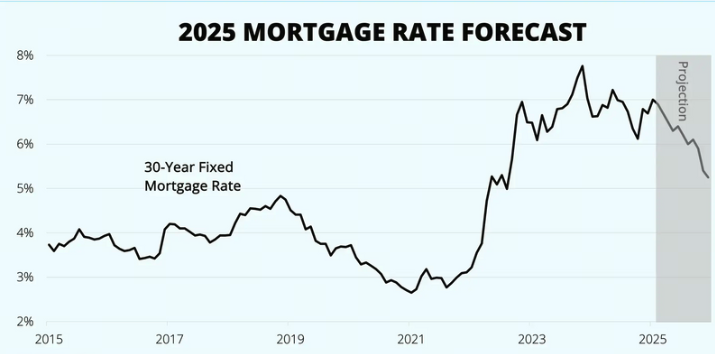

Understanding Mortgage Loan Types in the USA: A Comprehensive Guide for 2025

How to Secure the Best Mortgage Loan Rates in the USA for 2025

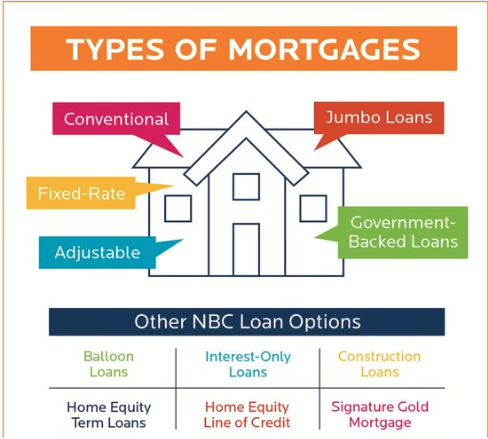

Navigating the Mortgage Loan Process in the USA: Tips for First-Time Homebuyers in 2025

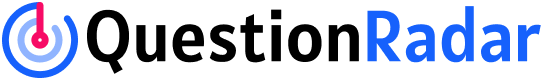

Impact of Economic Changes on Mortgage Loans in the USA: What to Expect in 2025

Best Mortgage Loans in the USA 2025: A Comprehensive Guide

The Future of Accident Claims: How Technology is Shaping the Role of Attorneys in 2025

The Role of Technology in Personal Injury Law: Insights for 2025