In 2025, securing a small business loan can be a daunting task for entrepreneurs. This guide offers essential tips to help navigate the complexities of financing options, from understanding loan types to improving credit scores. With practical advice and insights, aspiring business owners can confidently approach lenders and make informed decisions to support their ventures.

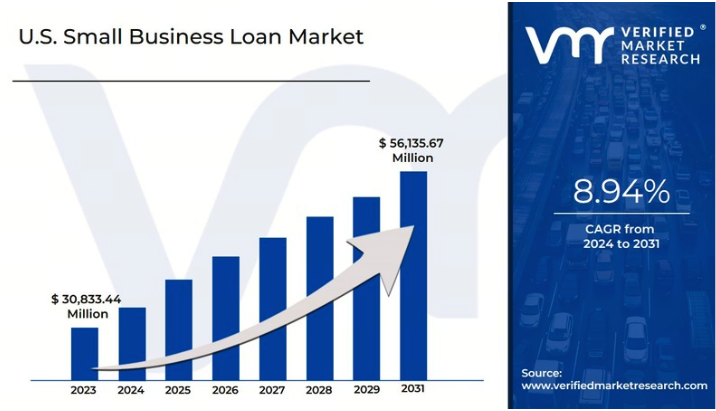

Understanding the Landscape of Small Business Loans in 2025

As we step into 2025, the landscape of small business loans continues to evolve, driven by technological advancements and changing economic conditions. Entrepreneurs seeking funding for their ventures need to be well-informed about the options available. Understanding these changes can significantly enhance your chances of securing the ideal loan for your business needs.

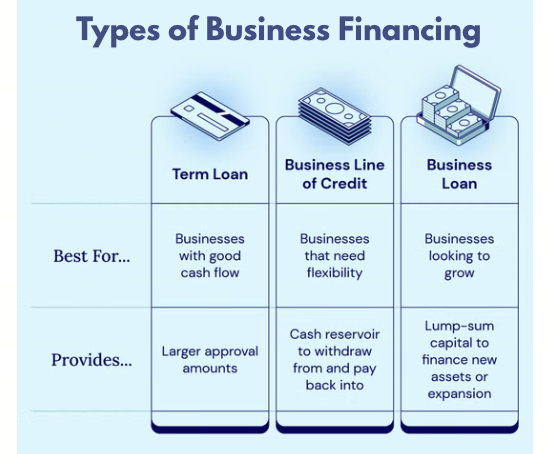

Types of Small Business Loans

In 2025, small business owners have access to a variety of loan types, each designed to meet different needs. Here are some of the most common options:

- Term Loans: These are traditional loans that provide a lump sum of capital, which is repaid over a specified period, usually with fixed interest rates.

- Lines of Credit: A flexible financing option that allows businesses to borrow as needed, up to a certain limit. Interest is paid only on the amount drawn.

- SBA Loans: Backed by the Small Business Administration, these loans typically offer lower interest rates and longer repayment terms, making them an attractive option for many entrepreneurs.

- Equipment Financing: Specifically designed for purchasing machinery or equipment, this type of loan allows businesses to spread the cost over time.

- Invoice Financing: Businesses can borrow against their unpaid invoices, providing quick access to cash while waiting for customer payments.

Preparing Your Business for a Loan Application

Before applying for a small business loan, preparation is key. Here are crucial steps to take:

- Clean Up Your Credit Score: Your credit score is one of the first things lenders will check. Ensure it is in good standing by paying off debts and correcting any errors.

- Gather Financial Documents: Prepare financial statements, tax returns, and cash flow projections. These documents will provide lenders with a clear picture of your business's financial health.

- Develop a Solid Business Plan: A well-structured business plan outlines your business goals, strategies, and financial projections, demonstrating to lenders that you have a clear vision for growth.

How to Choose the Right Lender

Choosing the right lender is just as important as the loan itself. Here are some tips to help you find the best fit:

- Research Different Lenders: Compare interest rates, fees, and terms from various lenders, including banks, credit unions, and online lenders.

- Look for Specialization: Some lenders specialize in specific industries or types of loans. Finding a lender with experience in your sector can enhance your chances of approval.

- Consider Customer Service: Efficient communication and support can make a significant difference throughout the loan process. Choose a lender known for excellent customer service.

Understanding Loan Terms and Conditions

Every loan comes with its own set of terms and conditions. Make sure you fully understand these before signing any agreement:

- Interest Rates: Know whether the rate is fixed or variable and how it will affect your repayments over time.

- Repayment Terms: Understand the schedule for repayments, including the length of the loan and any penalties for early repayment.

- Fees: Be aware of any additional fees associated with the loan, such as origination fees, late payment fees, or prepayment penalties.

Utilizing Technology in the Loan Application Process

In 2025, technology plays a pivotal role in simplifying the loan application process. Here’s how you can leverage it:

- Online Applications: Many lenders now offer completely online applications, making it easier to submit your documents and track your application status.

- Financial Management Tools: Utilize software that can help you manage your finances and prepare for your loan application, providing real-time insights into your business’s financial health.

- Credit Monitoring Services: Use online services to regularly monitor your credit score and receive alerts about changes, helping you stay on top of your credit health.

Common Mistakes to Avoid

When navigating the world of small business loans, avoiding common pitfalls can save you time, money, and frustration:

- Not Shopping Around: Failing to compare multiple lenders can lead to missing out on better rates and terms.

- Ignoring the Fine Print: Skipping the details of the loan agreement can result in unexpected costs or unfavorable conditions.

- Overborrowing: Taking on more debt than your business can handle can lead to cash flow issues and financial strain.

Conclusion: Empowering Your Business Journey

Navigating small business loans in 2025 requires careful planning and informed decision-making. By understanding the types of loans available, preparing your business adequately, and choosing the right lender, you can secure the funding necessary to grow your venture. Stay informed about technological advancements and market trends, and avoid common mistakes to empower your entrepreneurial journey.