Navigating the landscape of small business financing can be challenging. This comprehensive guide explores the top small business loans available in the USA for 2025, highlighting key options, eligibility criteria, and benefits. Whether you're a startup or an established company, discover tailored solutions to fuel your growth and achieve your entrepreneurial dreams with the right funding options.

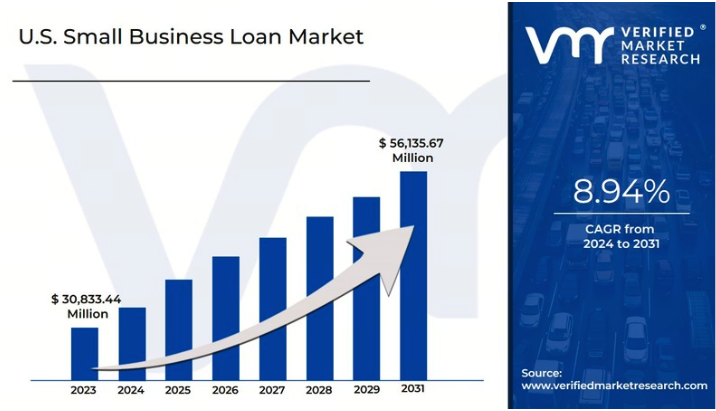

Small business loans are essential for entrepreneurs looking to start, grow, or manage their businesses effectively. In 2025, the landscape of small business financing continues to evolve, offering a variety of options tailored to meet the diverse needs of business owners. Understanding the different types of loans available can help you make informed decisions about which financing option is right for you.

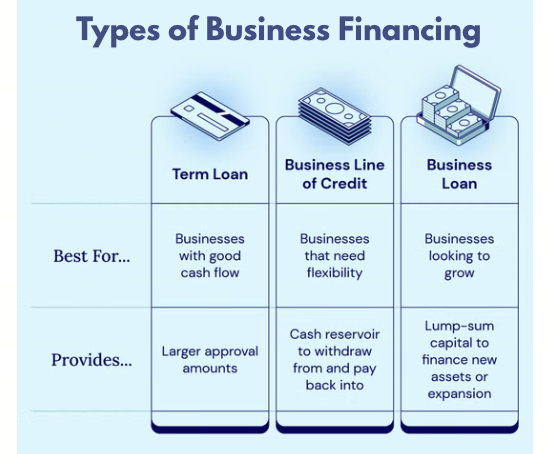

There are several types of small business loans available in the USA, each designed to cater to specific needs:

Based on current trends, here’s a comprehensive look at some of the top small business loans available in the USA for 2025:

| Loan Type | Lender | Interest Rate | Loan Amount | Term Length |

|---|---|---|---|---|

| SBA 7(a) Loan | Wells Fargo | 5.5% - 8.0% | $5,000 - $5,000,000 | 10 - 25 years |

| Business Line of Credit | Fundbox | 4.66% - 8.99% | $1,000 - $150,000 | 6 - 12 months |

| Term Loan | BlueVine | 4.8% - 6.2% | $10,000 - $250,000 | 6 - 12 months |

| Equipment Financing | OnDeck | 9.99% - 39.99% | $5,000 - $500,000 | 1 - 3 years |

| Invoice Financing | BlueVine | 0.5% - 2% per week | $5,000 - $5,000,000 | 30 - 90 days |

When selecting a small business loan, consider the following factors:

If traditional loans do not meet your needs, there are alternative financing options available:

In 2025, the small business loan landscape in the USA offers a myriad of options designed to suit various needs. Understanding the types of loans available and the factors to consider when choosing a lender can empower you to make informed decisions. Whether you opt for an SBA loan, a line of credit, or explore alternative financing options, being proactive in securing the right funding can lead your business toward success.

Secure Your Business's Future: Best Small Business Loans in 2025

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs

The Future of Small Business Loans: Trends to Watch in the USA for 2025

How to Qualify for Small Business Loans in 2025: A Step-by-Step Approach

Comparing Small Business Loan Options in the USA: 2025 Edition

The Impact of Technology on Small Business Loans: What to Expect in 2025

Government Grants vs. Small Business Loans: Which is Better for Your USA Business in 2025?

Success Stories: How Small Business Loans Transformed Enterprises in the USA by 2025