Discover how small business loans have played a pivotal role in transforming enterprises across the USA by 2025. This collection of success stories highlights inspiring examples of entrepreneurs who leveraged financial support to innovate, expand, and thrive in a competitive landscape. Explore the journeys of these businesses that turned challenges into opportunities and redefined their futures through strategic funding.

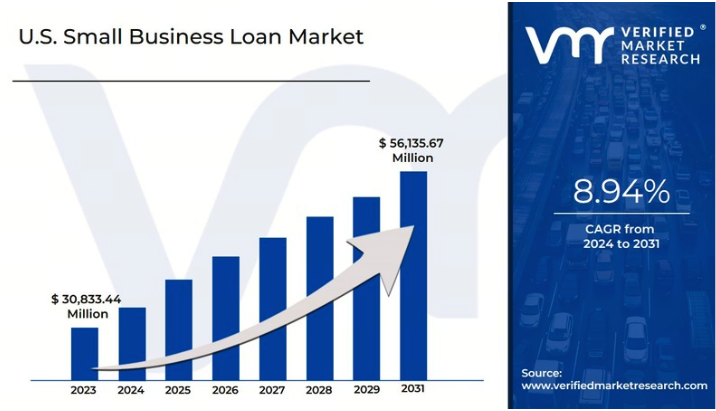

In recent years, small business loans have emerged as a vital resource for entrepreneurs across the USA. By 2025, these loans have not only facilitated growth but have also transformed the very fabric of local economies. The infusion of capital has enabled small enterprises to expand operations, hire more staff, and innovate their offerings, leading to improved customer experiences and increased market share.

One notable success story is that of Tech Innovations, a small tech startup based in Austin, Texas. With a modest initial investment, the company struggled to gain traction in a competitive market. However, after securing a small business loan of $200,000 in 2023, Tech Innovations was able to scale its operations rapidly. The loan allowed them to invest in advanced software development tools and hire skilled developers.

As a result, within two years, Tech Innovations saw a revenue increase of 150%, and their customer base expanded significantly. The company now employs over 50 individuals, contributing to the local economy and establishing itself as a leader in tech solutions.

Another inspiring example comes from Green Grocers, a family-owned organic food store in Seattle. Faced with stiff competition from larger retailers, the owners realized they needed to enhance their product offerings and improve store aesthetics. In 2024, they opted for a small business loan of $100,000.

This funding allowed Green Grocers to renovate their store, expand their inventory, and implement a marketing campaign that highlighted their commitment to sustainability. By 2025, sales had increased by 80%, and they were able to employ additional staff, thus creating local jobs. The success of Green Grocers exemplifies how small business loans can lead to significant transformations in retail.

Below is a chart showcasing the growth metrics of various small businesses after securing loans:

| Business Name | Loan Amount | Revenue Increase (%) | New Jobs Created |

|---|---|---|---|

| Tech Innovations | $200,000 | 150% | 30 |

| Green Grocers | $100,000 | 80% | 10 |

| Craft Brewery | $250,000 | 120% | 15 |

| Fitness Studio | $150,000 | 90% | 8 |

The craft beer revolution has taken the USA by storm, and one small brewery in Portland, Oregon, exemplifies this trend. The owners of Craft Brewery recognized that to meet growing demand, they needed to increase their production capacity. In 2024, they secured a $250,000 small business loan.

This investment allowed them to upgrade brewing equipment and expand their distribution channels. By 2025, Craft Brewery reported a 120% increase in revenue and created 15 new jobs, showcasing how small business loans can empower enterprises to thrive in competitive industries.

Another success story is that of a local fitness studio in Miami, Florida. Faced with the challenges of a saturated market, the owner sought a $150,000 loan in 2023 to revamp the studio and introduce new fitness classes. With the loan, they enhanced their facilities and launched a marketing campaign targeting health-conscious individuals.

By 2025, the fitness studio experienced a revenue increase of 90% and added eight new employees. This case illustrates how small business loans can significantly impact service-oriented businesses, enhancing community engagement and fostering a healthier lifestyle.

The success stories of these small businesses highlight the broader economic impact of small business loans throughout the USA. According to recent data, small businesses account for approximately 47% of private sector employment and 44% of economic activity. By providing essential funding, small business loans not only foster individual enterprise growth but also contribute to job creation and community development.

As we look ahead to 2025 and beyond, the trend of small business loans will likely continue to play a crucial role in shaping the entrepreneurial landscape of the USA. With increased access to funding and supportive lending programs, more small businesses will have the opportunity to innovate and expand, driving economic growth and enhancing local communities.

In conclusion, the transformative power of small business loans cannot be underestimated. They serve as a lifeline for many entrepreneurs, providing the necessary capital to turn dreams into reality. As these success stories demonstrate, the impact of these loans is felt not only by the businesses themselves but also by the communities they serve.

The Impact of Technology on Small Business Loans: What to Expect in 2025

Government Grants vs. Small Business Loans: Which is Better for Your USA Business in 2025?

Secure Your Business's Future: Best Small Business Loans in 2025

Top Small Business Loans in the USA for 2025: A Comprehensive Guide

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs

The Future of Small Business Loans: Trends to Watch in the USA for 2025

How to Qualify for Small Business Loans in 2025: A Step-by-Step Approach

Comparing Small Business Loan Options in the USA: 2025 Edition