Navigating funding options is crucial for entrepreneurs in 2025, and choosing between government grants and small business loans can significantly impact your business's success. Government grants offer non-repayable funds that can foster innovation, while small business loans provide immediate capital with repayment obligations. Understanding the benefits and drawbacks of each option will help you make an informed decision for your USA business.

When it comes to financing your small business in the USA, understanding the differences between **government grants** and **small business loans** is crucial. Each option has its unique advantages and disadvantages, and the best choice will depend on your specific business needs, goals, and financial situation. In 2025, as the economic landscape continues to evolve, knowing which option to pursue can significantly impact your business's success.

**Government grants** are funds provided by federal, state, or local governments to support business initiatives, particularly those that contribute to economic development, innovation, or community improvement. One of the most appealing aspects of grants is that they do not require repayment, making them an attractive option for entrepreneurs.

However, securing a **government grant** can be a lengthy and competitive process. Grants often come with strict eligibility requirements and specific guidelines on how the funds can be used. Additionally, there may be ongoing reporting requirements to ensure compliance with the terms of the grant.

In 2025, as the government continues to prioritize economic recovery and growth, there may be an increase in available grants, particularly in sectors focusing on sustainability, technology, and community development. Business owners should be prepared to invest time in researching and applying for grants that fit their business model.

1. **No Repayment Required**: The most significant advantage of **government grants** is that they do not need to be repaid. This allows business owners to utilize the funds without the burden of future debt.

2. **Encouragement of Innovation**: Many grants are designed to promote innovation and research, which can help businesses develop new products or improve existing services.

3. **Support for Specific Causes**: Grants often focus on specific areas such as environmental sustainability, minority-owned businesses, or rural development, providing targeted support for initiatives that align with government priorities.

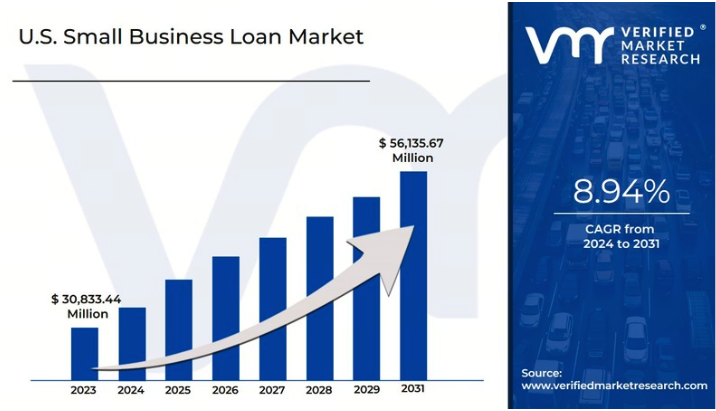

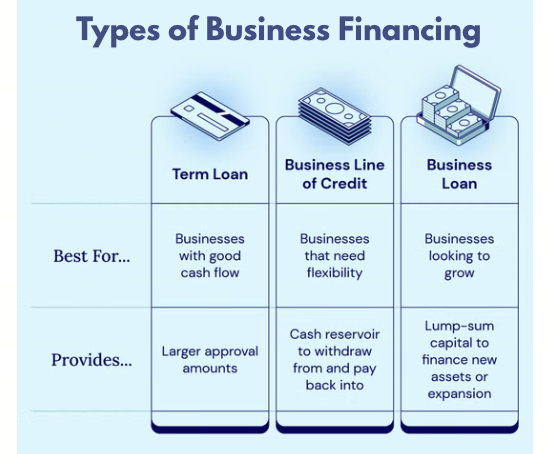

On the other hand, **small business loans** are financial products offered by banks, credit unions, and online lenders that must be repaid with interest over time. These loans can be used for various purposes, including purchasing inventory, equipment, or real estate, and they generally provide a larger amount of funding compared to grants.

One of the primary advantages of a **small business loan** is the speed and accessibility of funding. Many lenders offer streamlined application processes and quick approvals, allowing businesses to access capital when they need it most. Furthermore, loans can be tailored to fit the specific needs of the business, offering flexibility in terms of repayment plans and interest rates.

1. **Access to Larger Amounts of Capital**: **Small business loans** can provide significant amounts of funding, enabling businesses to invest in growth or cover operational costs.

2. **Flexible Use of Funds**: Unlike grants, which often have specific usage guidelines, loan funds can typically be used for a variety of business purposes, giving entrepreneurs the freedom to allocate resources where needed.

3. **Building Credit History**: Successfully repaying a **small business loan** can help establish or improve your business credit score, making it easier to secure funding in the future.

| Feature | Government Grants | Small Business Loans |

|---|---|---|

| Repayment | No repayment required | Must be repaid with interest |

| Application Process | Lengthy and competitive | Typically faster and more straightforward |

| Funding Amount | Can be larger amounts | |

| Flexibility of Use | Restricted to specific purposes | Flexible usage |

| Impact on Credit | No impact | Can build business credit |

The choice between **government grants** and **small business loans** will depend on your individual circumstances. If you are looking to fund a specific project that aligns with government priorities and can navigate the application process, a grant may be the best option. However, if you need quick access to capital with fewer restrictions, a **small business loan** might be more suitable.

In conclusion, as we move into 2025, it is essential for small business owners to carefully evaluate their financing options. Understanding the differences between **government grants** and **small business loans** can empower you to make informed decisions that align with your business goals and financial needs.

Ultimately, the right choice may also involve a combination of both options, allowing you to leverage the strengths of each to fuel your business's growth and success.

Secure Your Business's Future: Best Small Business Loans in 2025

Top Small Business Loans in the USA for 2025: A Comprehensive Guide

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs

The Future of Small Business Loans: Trends to Watch in the USA for 2025

How to Qualify for Small Business Loans in 2025: A Step-by-Step Approach

Comparing Small Business Loan Options in the USA: 2025 Edition

The Impact of Technology on Small Business Loans: What to Expect in 2025

Success Stories: How Small Business Loans Transformed Enterprises in the USA by 2025