Discover the best small business loans tailored to your needs. From traditional bank loans to online lenders and SBA loans, find flexible financing options with competitive rates to fuel your business growth.

Welcome to the ultimate guide to finding the best small business loans for your company's needs in 2025. Whether you're looking to expand your operations, purchase new equipment, or manage cash flow, securing the right financing can be a game-changer for small businesses. In this comprehensive guide, we'll explore the top small business loan options available in 2025, helping you navigate the lending landscape and find the perfect funding solution to fuel your business's growth and success.

Securing the best small business loan is a strategic decision that can propel your business forward and unlock new opportunities for growth and success. With our guide to the top small business loans in 2025, you can confidently explore your financing options and find the perfect solution to fuel your business's ambitions. Whether you're looking for traditional bank loans, SBA loans, online lenders, or alternative financing options like invoice financing, the right loan is within reach. Explore these options today and take the first step towards securing the funding your business needs to thrive.

Top Small Business Loans in the USA for 2025: A Comprehensive Guide

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs

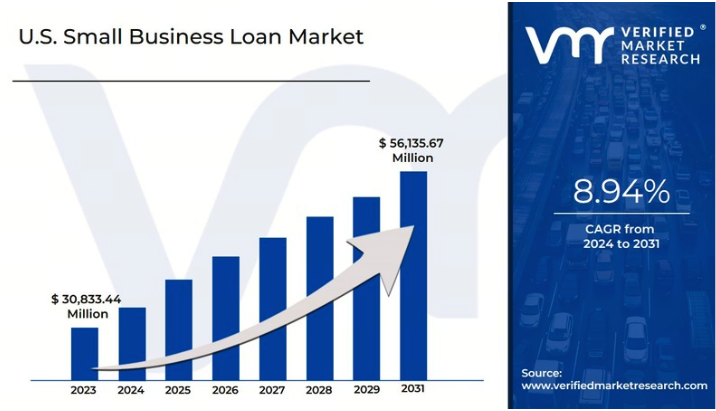

The Future of Small Business Loans: Trends to Watch in the USA for 2025

How to Qualify for Small Business Loans in 2025: A Step-by-Step Approach

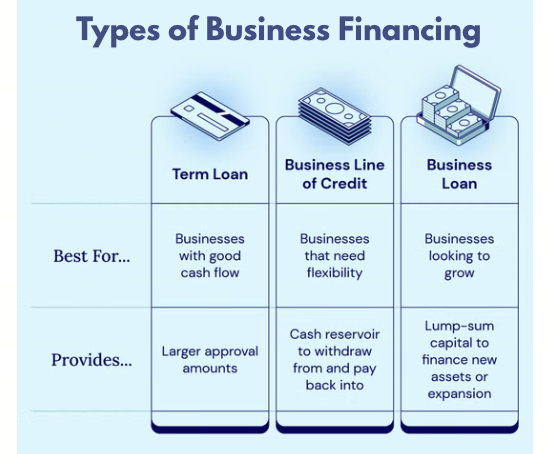

Comparing Small Business Loan Options in the USA: 2025 Edition

The Impact of Technology on Small Business Loans: What to Expect in 2025

Government Grants vs. Small Business Loans: Which is Better for Your USA Business in 2025?

Success Stories: How Small Business Loans Transformed Enterprises in the USA by 2025