Dental insurance is an essential component of overall health care, providing financial support for necessary dental procedures. As we look toward 2025, it's crucial to be informed about the **top dental insurance plans** available in the USA. Choosing the right plan can make a significant difference in your dental care experience, including coverage for routine check-ups, major dental work, and orthodontics.

Before diving into the top plans for 2025, it’s important to understand the key factors to consider when selecting a **dental insurance plan**. These factors include:

Here’s a look at some of the best **dental insurance plans** in the USA for 2025:

| Insurance Provider | Type of Plan | Monthly Premium | Annual Maximum | Coverage Details |

|---|---|---|---|---|

| Delta Dental | PPO | $35 | $2,000 | 100% preventive, 80% basic, 50% major |

| Cigna | DHA | $30 | $1,500 | 100% preventive, 70% basic, 50% major |

| MetLife | PPO | $40 | $2,500 | 100% preventive, 80% basic, 50% major |

| Humana | DHMO | $25 | No Limit | 100% preventive, 80% basic, 50% major |

| Aetna | PPO | $38 | $2,000 | 100% preventive, 80% basic, 50% major |

Delta Dental is one of the largest dental insurance providers in the USA. With a variety of plans, their **PPO plan** offers access to a vast network of dentists. Members can enjoy 100% coverage for preventive care, such as cleanings and exams, making it an excellent choice for families focused on **preventive dental care**.

Cigna's **Dental Health Alliance (DHA)** plan is designed for those looking for affordable coverage. With lower monthly premiums, it provides a solid balance between cost and coverage. Members receive significant coverage for preventive services and can choose from a wide network of dental providers.

MetLife offers a robust **PPO plan** with one of the highest annual maximums in the industry. This plan is ideal for individuals who anticipate needing extensive dental work, as it covers a broad range of services from preventive to major procedures. Their extensive network also ensures members have plenty of options when choosing a dentist.

Humana's **DHMO plan** is unique in that it offers no annual maximums, making it a great choice for those who expect to undergo multiple treatments. With lower out-of-pocket costs for services, Humana is an attractive option for those looking for comprehensive coverage.

Aetna provides a competitive **PPO plan** that includes comprehensive coverage and a wide range of dentist networks. With reasonable premiums and a solid annual maximum, Aetna is well-suited for individuals seeking a balance between cost and quality of care.

As you explore your options for **dental insurance in 2025**, remember that the best plan for you will depend on your individual needs, budget, and dental health history. It's essential to compare different plans, understand the coverage details, and consider factors like waiting periods and networks. By doing thorough research, you can find an insurance plan that best fits your lifestyle and ensures that you receive the dental care you need.

With this information in hand, you are now better equipped to navigate the evolving landscape of dental insurance and select the right plan for your future dental health needs.

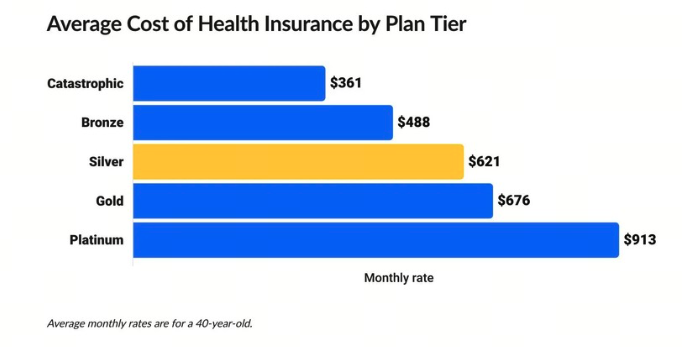

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Affordable Life Insurance Plans: What You Need to Know in 2025

Top Dental Insurance Plans in the USA – Protect Your Smile in 2025

Home Renovation in the USA: What You Need to Know in 2025

Top 5 Online Banks in the USA 2025: Features and Benefits You Need to Know

Top 10 Cell Phone Deals in the USA for 2025: What You Need to Know

Common Misconceptions About Dental Insurance in 2025: What Patients Should Know

Changes in Personal Injury Legislation: What Attorneys Need to Know for 2025