Discover the Top 5 Online Banks in the USA 2025, where innovation meets convenience. These banks offer high-interest savings accounts, minimal fees, and robust mobile banking features. Enjoy seamless money management tools and top-notch customer support. Whether you're looking for competitive rates or user-friendly interfaces, these online banks provide the essential benefits to enhance your banking experience.

As we move further into 2025, the landscape of online banking continues to evolve, offering consumers innovative features and benefits. Below, we highlight the **Top 5 Online Banks in the USA** for 2025, detailing their standout features, advantages, and what makes them a preferred choice for customers looking for modern banking solutions.

Ally Bank remains a frontrunner in the online banking sector, known for its competitive interest rates and customer-centric services. One of the standout features of Ally is its **no monthly maintenance fees**, making it an attractive option for those who want to avoid unnecessary charges. Additionally, Ally offers:

With its comprehensive suite of financial products including auto loans and investment options, Ally Bank is designed to cater to a wide range of customer needs.

Discover Bank is not just famous for its credit cards; it also excels in the online banking arena. With strong **customer satisfaction ratings**, Discover offers a variety of financial products that appeal to both savers and borrowers. Key features include:

Moreover, Discover’s user-friendly online platform and mobile app make banking effortless for customers, emphasizing convenience and transparency.

Chime has made a name for itself as a digital banking alternative, especially popular among millennials and Gen Z. With an emphasis on **financial wellness**, Chime provides a range of features that help users manage their money effectively. Notable benefits include:

Chime’s focus on simplicity and accessibility positions it as a favorite among tech-savvy consumers seeking efficient banking solutions.

Marcus by Goldman Sachs is widely recognized for its **high-yield savings accounts** and **no-fee personal loans**. This online bank is ideal for customers who prioritize savings and investment. Here are some key features:

Marcus also offers tools and resources for financial planning, making it a valuable partner for those looking to grow their wealth over time.

Capital One 360 is known for its comprehensive and flexible banking options. The online division of Capital One offers a range of products that cater to various financial needs. Key features include:

Capital One 360 also provides a variety of financial tools and calculators, empowering customers to make informed decisions about their money.

| Bank | Monthly Fees | High-Yield Savings APY | Mobile App | Customer Support |

|---|---|---|---|---|

| Ally Bank | No | Up to 4.00% | Yes | 24/7 |

| Discover Bank | No | Up to 4.00% | Yes | 24/7 |

| Chime | No | Up to 2.00% | Yes | 24/7 |

| Marcus by Goldman Sachs | No | Up to 3.50% | Yes | Mon-Fri |

| Capital One 360 | No | Up to 4.00% | Yes | 24/7 |

In conclusion, choosing the right online bank in 2025 can significantly impact your financial health. Each of the **Top 5 Online Banks in the USA** offers unique features and benefits tailored to meet the diverse needs of consumers. By understanding what each bank has to offer, you can make an informed decision that aligns with your financial goals.

Comparing Online Banks vs. Traditional Banks in the USA: What's Best for You in 2025?

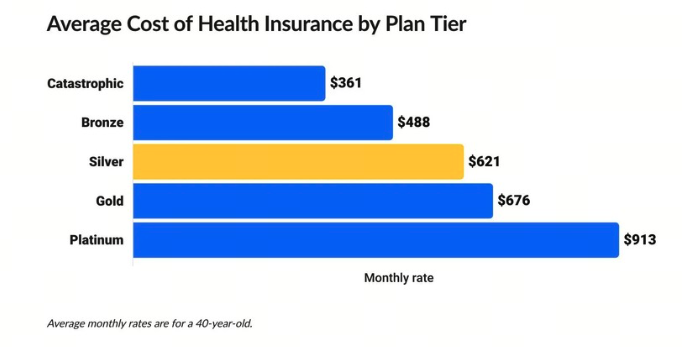

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Home Renovation in the USA: What You Need to Know in 2025

Top 10 Cell Phone Deals in the USA for 2025: What You Need to Know

Top Dental Insurance Plans in the USA for 2025: What You Need to Know

Online Banks in the USA 2025: The Rise of Digital-Only Banking

How Online Banks are Revolutionizing Personal Finance in the USA by 2025

Security Concerns: How Online Banks in the USA are Protecting Your Money in 2025