Online banks, also known as digital banks or virtual banks, operate primarily through the internet. They provide a range of financial services, including checking and savings accounts, loans, and credit cards, without the traditional brick-and-mortar branches. The rise of online banking has transformed the financial landscape, making it crucial for consumers to understand its advantages and disadvantages.

1. Higher Interest Rates: One of the most significant benefits of online banks is their ability to offer higher interest rates on savings accounts and CDs. This is largely because they have lower overhead costs compared to traditional banks.

2. Lower Fees: Many online banks have fewer fees, such as monthly maintenance fees, overdraft fees, and ATM fees. This can lead to substantial savings over time, particularly for those who are budget-conscious.

3. Convenience: Online banking provides unparalleled convenience. Customers can manage their accounts 24/7 from anywhere with an internet connection. This flexibility is ideal for busy individuals who prefer to conduct their banking transactions on their schedules.

4. Innovative Technology: Online banks often utilize the latest technology to enhance user experience, offering mobile apps that allow for easy fund transfers, budgeting tools, and real-time notifications.

1. Limited Customer Service: While many online banks offer customer support via chat or phone, they lack the face-to-face interaction that traditional banks provide. This can be a drawback for customers who prefer in-person assistance.

2. No Physical Branches: For some customers, the absence of physical locations can be a disadvantage. Individuals who prefer to deposit cash or checks may find it inconvenient to use an online bank.

3. Technology Reliance: Online banking requires a reliable internet connection and some level of tech-savviness. Those who are uncomfortable with technology may find it challenging to navigate online banking systems.

Traditional banks, also known as brick-and-mortar banks, have physical locations where customers can conduct banking transactions. These banks have been around for centuries and offer a wide range of financial services.

1. In-Person Service: One of the most significant advantages of traditional banks is the ability to speak with a teller or bank representative directly. This can be beneficial for customers who need assistance with complex financial matters.

2. Access to Cash Services: Traditional banks allow customers to deposit cash and checks easily, making them a suitable option for those who frequently deal in cash transactions.

3. Established Trust: Many consumers feel a sense of security with established banks that have been operating for years. This trust can be essential when it comes to managing significant amounts of money.

1. Lower Interest Rates: Traditional banks often provide lower interest rates on savings accounts and CDs compared to online banks, which can make them less appealing for those looking to grow their savings.

2. Higher Fees: Many traditional banks charge various fees, including monthly maintenance fees and transaction fees, which can quickly add up and erode savings.

3. Limited Hours: Traditional banks typically have set hours of operation, which may not align with customers' schedules. This limitation can be frustrating for those who need to handle banking matters outside of regular business hours.

| Feature | Online Banks | Traditional Banks |

|---|---|---|

| Interest Rates | Higher | Lower |

| Fees | Lower | Higher |

| Customer Service | Primarily online | In-person available |

| Access to Cash | Limited | Easy access |

| Convenience | 24/7 online access | Limited hours |

As we look ahead to 2025, the choice between online banks and traditional banks will depend on individual preferences and financial needs. If you prioritize higher interest rates and lower fees and are comfortable using technology, an online bank may be the best option for you. On the other hand, if you value in-person service and need easy access to cash, a traditional bank might suit you better.

In conclusion, both online banks and traditional banks offer unique advantages and disadvantages. Consider your financial goals, banking habits, and comfort level with technology when deciding which banking option is the best fit for you in 2025.

Comparing Solar Roof Tiles vs. Traditional Solar Panels: What to Expect in 2025

Crossover SUVs vs. Traditional SUVs: What to Expect in 2025

Top 5 Online Banks in the USA 2025: Features and Benefits You Need to Know

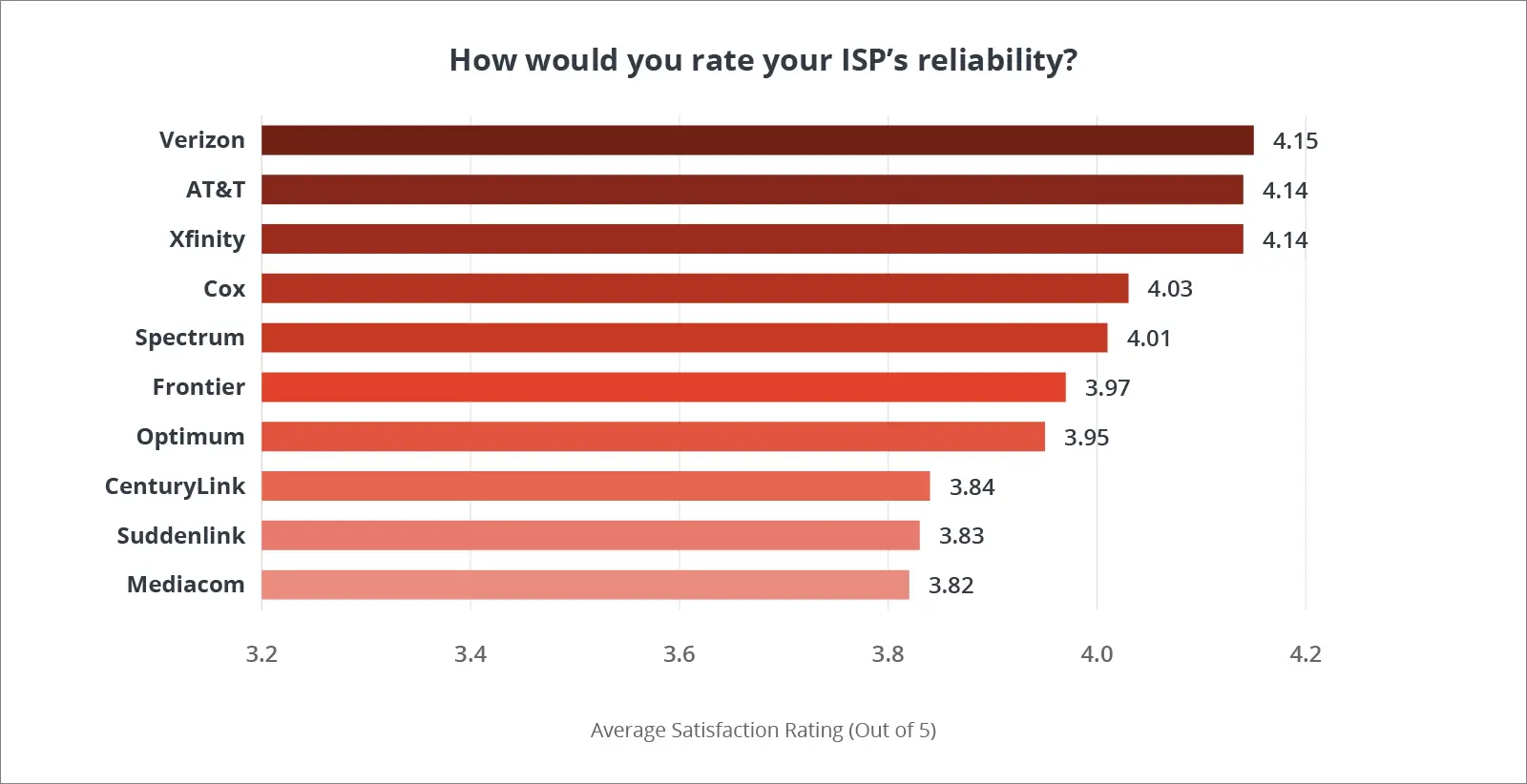

Comparing Speed and Reliability: Best Business Internet Providers in the USA 2025

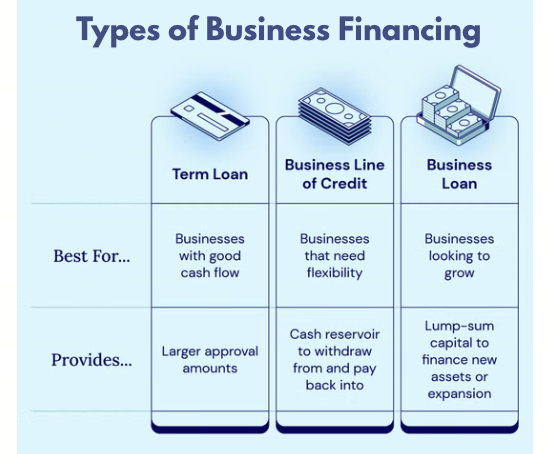

Comparing Small Business Loan Options in the USA: 2025 Edition

Online Banks in the USA 2025: The Rise of Digital-Only Banking

How Online Banks are Revolutionizing Personal Finance in the USA by 2025

Security Concerns: How Online Banks in the USA are Protecting Your Money in 2025