Discover the Best Online Banks of 2025, where security meets innovation. These banks offer fee-free accounts, ensuring your savings grow without hidden charges. Enjoy smart banking features like advanced budgeting tools and seamless mobile experiences. With top-notch customer service and robust fraud protection, these institutions are set to redefine your banking experience, making it easier and safer than ever.

As we step into 2025, the landscape of online banking continues to evolve, offering consumers more options than ever. With an emphasis on security, smart features, and fee-free structures, several online banks stand out in this competitive market. Here’s a look at the Best Online Banks of 2025 that are leading the charge in providing customers with exceptional banking experiences.

Ally Bank remains a top contender in the online banking sector due to its customer-centric approach and robust digital tools. Known for its high-yield savings accounts and competitive interest rates, Ally Bank offers a seamless online experience without any monthly maintenance fees. Additionally, its user-friendly mobile app allows customers to manage their finances effortlessly.

Discover Bank is not just a credit card issuer; it also provides an excellent online banking experience. With no monthly fees and a high-interest savings account, Discover appeals to those looking to maximize their savings. Customers can benefit from a user-friendly interface and exceptional customer service, making it a reliable choice for digital banking.

Chime has made a name for itself as a fee-free banking alternative, particularly appealing to younger consumers. With no overdraft fees, monthly service fees, or minimum balance requirements, Chime promotes a stress-free banking experience. Moreover, its automated savings features and early direct deposit options make it a smart choice for those looking to save effortlessly.

Capital One 360 offers a wide array of products, including checking and savings accounts with no monthly fees. Its innovative mobile app provides tools for budgeting and savings, making it easier for customers to manage their finances. With a strong focus on security, Capital One ensures that customer data is protected, giving users peace of mind.

Marcus by Goldman Sachs is another excellent option for online banking in 2025, especially for those looking to grow their savings. With high-interest rates on savings accounts and no fees, Marcus provides a straightforward approach to banking. Their online platform is easy to navigate, and they offer tools to help customers track their financial goals.

SoFi Money combines the features of a bank account with investment options, making it a unique offering in the online banking space. With no account fees and a competitive interest rate, SoFi Money allows users to earn interest on their balance while having the flexibility to invest in stocks and ETFs. Its intuitive app is designed for tech-savvy customers who value both banking and investing.

Varo Bank is known for its commitment to fee-free banking and financial education. Offering a high-yield savings account with no monthly fees, Varo encourages customers to save more. Its app provides personalized insights into spending and saving habits, helping users make informed financial decisions. Additionally, Varo’s early direct deposit feature is a significant draw for many customers.

N26 is a European bank that has made its mark in the U.S. market, offering a digital banking experience that emphasizes minimal fees and maximum convenience. With no monthly maintenance fees and free ATM withdrawals globally, N26 is ideal for travelers and digital nomads. Its sleek mobile app allows for easy management of finances, making it an attractive option for tech-savvy individuals.

| Bank | No Monthly Fees | High-Yield Savings | Mobile App Features |

|---|---|---|---|

| Ally Bank | Yes | Yes | User-friendly, budgeting tools |

| Discover Bank | Yes | Yes | Easy navigation, exceptional service |

| Chime | Yes | No | Automated savings, early deposit |

| Capital One 360 | Yes | Yes | Budgeting tools, strong security |

| Marcus by Goldman Sachs | Yes | Yes | Financial goal tracking |

| SoFi Money | Yes | Yes | Investing options, intuitive design |

| Varo Bank | Yes | Yes | Personalized insights |

| N26 | Yes | No | Sleek interface, global ATM access |

As we navigate the world of online banking in 2025, it's clear that consumers have a wealth of options that prioritize security, smart features, and fee-free banking. By selecting an online bank that aligns with their financial needs and lifestyle, individuals can take control of their finances and enjoy a more rewarding banking experience.

Comparing Online Banks vs. Traditional Banks in the USA: What's Best for You in 2025?

Online Banks in the USA 2025: The Rise of Digital-Only Banking

Top 5 Online Banks in the USA 2025: Features and Benefits You Need to Know

How Online Banks are Revolutionizing Personal Finance in the USA by 2025

Security Concerns: How Online Banks in the USA are Protecting Your Money in 2025

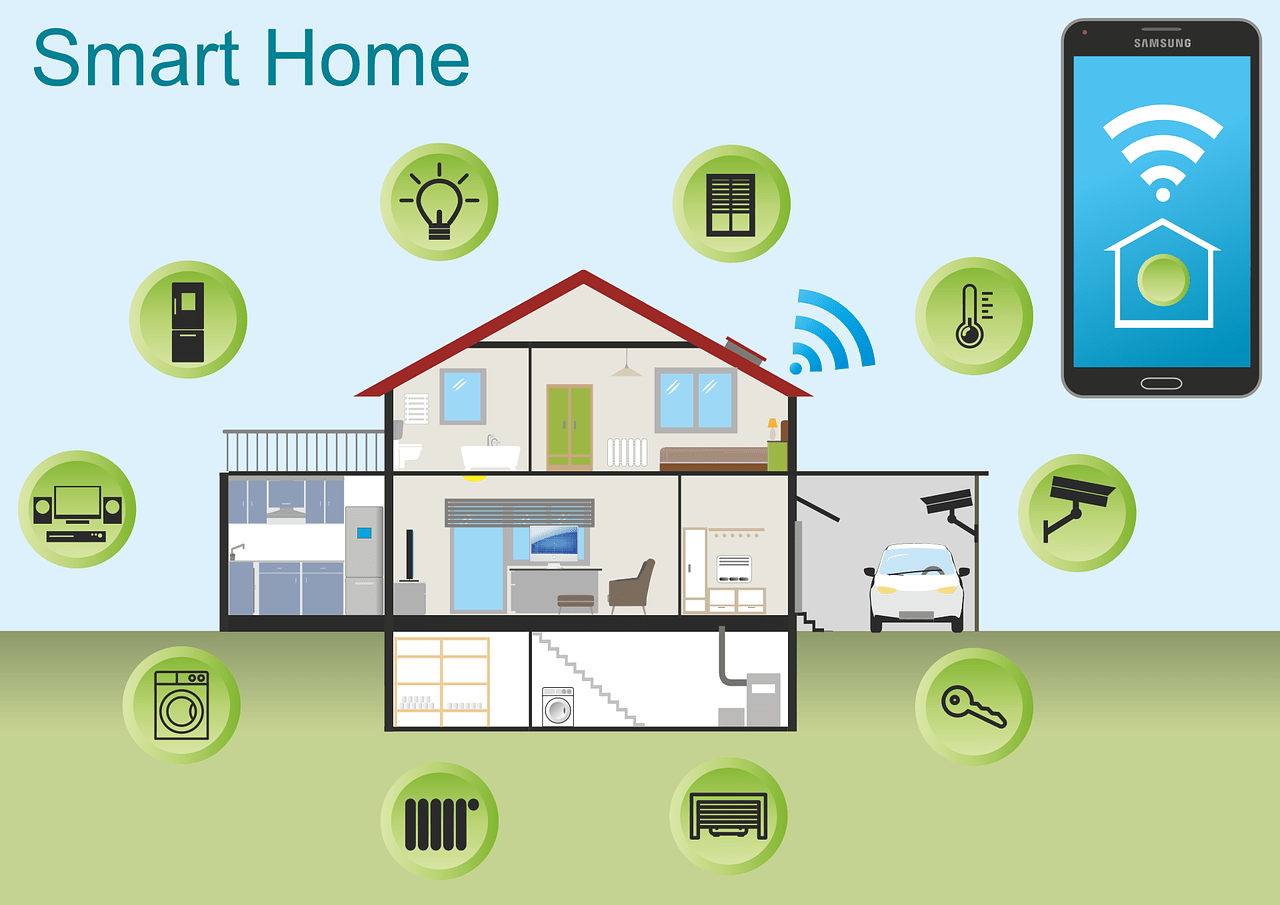

The Importance of Smart Home Integration in 2025's Best Security Systems

The Future of Smart Home Renovations: What Contractors Need to Know in 2025.

How to Secure the Best Mortgage Loan Rates in the USA for 2025