As we approach 2025, the future of online banking in the USA is poised for significant transformation. Key trends to watch include the rise of AI-driven customer service, enhanced cybersecurity measures, and the integration of blockchain technology. Additionally, the increasing demand for mobile banking solutions will drive banks to prioritize user experience and personalization in their digital offerings.

The landscape of online banking in the USA is rapidly evolving, driven by technological advancements, changing consumer preferences, and regulatory shifts. As we look toward 2025, several key trends are expected to shape the future of online banking, making it more efficient, user-friendly, and secure. Here are some of the most significant trends to watch for in the coming years.

Artificial Intelligence is set to revolutionize online banking in the USA by offering personalized financial services. AI algorithms can analyze customer data to provide tailored recommendations for investments, savings, and loans. Banks are also using AI to enhance customer service through chatbots and virtual assistants, which can handle queries 24/7. This trend not only improves customer satisfaction but also reduces operational costs for banks.

As mobile devices become the primary means of accessing banking services, banks are investing heavily in enhancing their mobile banking platforms. By 2025, we can expect to see more intuitive user interfaces, faster transaction speeds, and additional features such as budgeting tools and financial health trackers. The demand for mobile-first banking experiences is driven by younger consumers who prioritize convenience and accessibility.

Blockchain technology is gaining traction in the online banking sector due to its ability to provide secure and transparent transactions. By 2025, we can anticipate more banks leveraging blockchain for various applications, including cross-border payments, smart contracts, and secure identity verification. This integration will not only improve security but also streamline operations, reducing the time and cost associated with traditional banking processes.

Neobanks, or digital-only banks, are becoming increasingly popular as consumers seek more flexible and innovative banking options. These institutions often offer lower fees, higher interest rates on savings, and user-friendly interfaces. By 2025, it is expected that neobanks will capture a larger share of the market, forcing traditional banks to adapt by enhancing their digital offerings and improving customer service.

As online banking becomes more prevalent, so does the concern over cybersecurity threats. Banks and financial institutions will need to prioritize cybersecurity strategies to protect customer data and build trust. By 2025, we expect to see increased investment in advanced security measures such as biometric authentication, multi-factor authentication, and machine learning algorithms designed to detect fraudulent activities in real-time.

Consumers are increasingly looking for comprehensive financial management solutions within their banking apps. By 2025, we anticipate that online banks will offer robust personal finance management tools that help users track spending, create budgets, and set financial goals. These features will empower customers to make informed financial decisions and improve their overall financial health.

As the online banking landscape evolves, regulatory frameworks will also adapt. By 2025, banks will need to navigate a complex web of regulations aimed at ensuring consumer protection, data privacy, and financial stability. Staying compliant will require banks to invest in technology that can help them monitor transactions and report suspicious activities, thereby safeguarding their operations and customer trust.

With growing awareness around climate change and social issues, consumers are increasingly favoring banks that demonstrate a commitment to sustainability and social responsibility. By 2025, we can expect online banks to implement eco-friendly practices, such as reducing paper usage, offering green investment options, and supporting community initiatives. This focus on sustainability will not only attract customers but also enhance brand loyalty.

Open banking is a system that allows third-party developers to build applications and services around financial institutions. By 2025, we expect the open banking model to become more mainstream in the USA, providing consumers with greater control over their financial data and enabling them to access a wider range of financial services. This trend will foster innovation and competition among banks and fintech companies alike.

As competition intensifies in the online banking sector, providing an exceptional user experience will be crucial for banks. By 2025, we anticipate that banks will prioritize UX design, ensuring that their platforms are not only functional but also visually appealing and easy to navigate. A seamless user experience will be key to retaining customers and attracting new ones in an increasingly crowded market.

In conclusion, the future of online banking in the USA is poised for transformation by 2025, driven by technological advancements, changing consumer expectations, and a focus on security and user experience. By staying ahead of these trends, banks can better serve their customers and remain competitive in the ever-evolving financial landscape.

The Future of Online Advertising in the USA: Trends to Watch in 2025

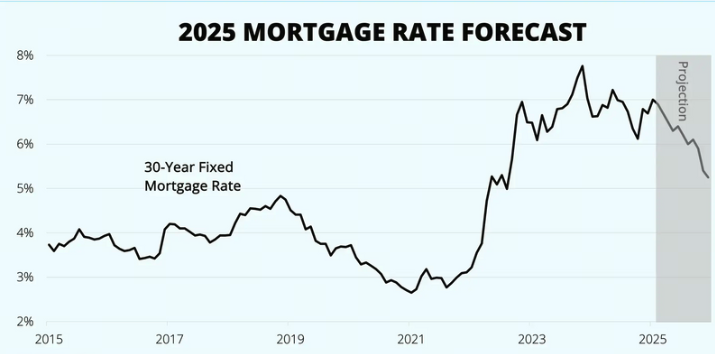

The Future of Mortgage Loans in the USA: Trends to Watch in 2025

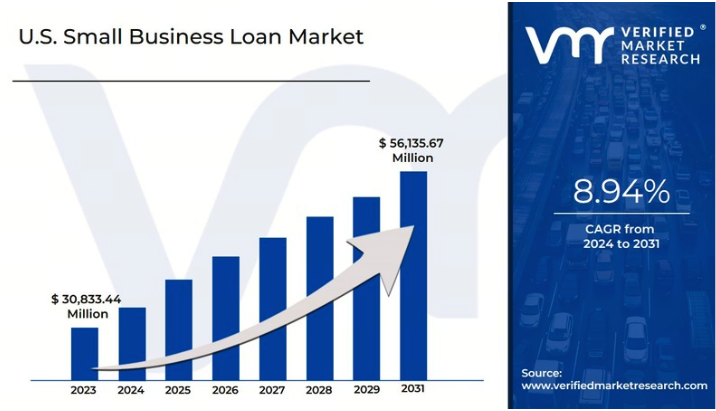

The Future of Small Business Loans: Trends to Watch in the USA for 2025

The Future of Cloud Web Security in the USA: Trends to Watch in 2025

Future Trends in Mesothelioma Litigation: The Best Lawyers to Watch in 2025.

Innovative Features of Savings Accounts in the USA: Trends to Watch in 2025

Top Roofing Companies in the USA: Trends and Innovations to Watch in 2025

The Future of Online Banking: Top Digital Savings Accounts in the USA for 2025